Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

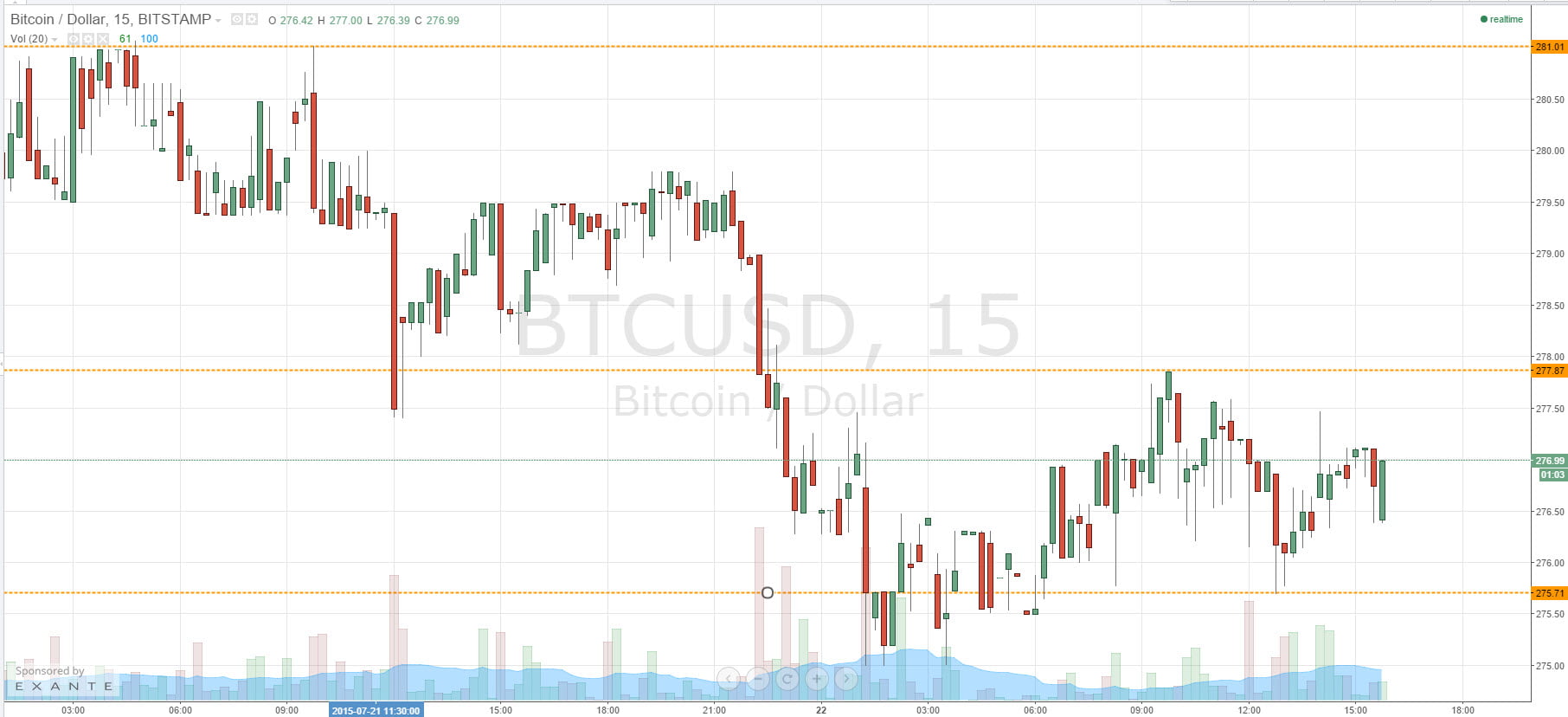

Late yesterday evening, shortly before the markets closed in Europe, we published our twice-daily bitcoin price watch piece. In the piece, we highlighted the levels that we would be watching throughout the evening and during the Asian session, and suggested how we would get in and out of the markets according to our breakout strategy – primarily because our intra-range strategy that we incorporated during the beginning of this week was unavailable to us. Now action has matured overnight, what of levels that we are watching in the bitcoin price during today’s session, which of our strategies will we be implementing in order to try and draw profit from the market? Take a quick look at the chart.

The problem we are having with the bitcoin price at the moment is its erraticism. While we are getting breakouts, these breakouts or any lasting for more than a couple of hours, and we are not quite reaching our intraday targets as a result. This choppy action means we are getting pulled out of trades early – albeit just for small losses as a result of our stop loss placement, but for losses nonetheless. So, in today’s trading, we are going to look at slightly shorter targets than normal, while incorporating our traditional breakout strategy on action.

The levels to keep an eye on our in term support at 275 flat and resistance at 277.43. If we can get a break above 277.43, it will put us long towards 280 flat. With about three dollars worth of reward here, we will look to place a stop loss somewhere around 276.5, giving us a risk reward profile of about 2 to one.

Looking the other way, if the downside momentum holds firm, and we get a break below 275 flat, will once again look for a three dollar target of 272 flat, with a stop loss somewhere around 276 maintaining a positive risk reward profile on the trade.

Charts courtesy of Trading View