Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

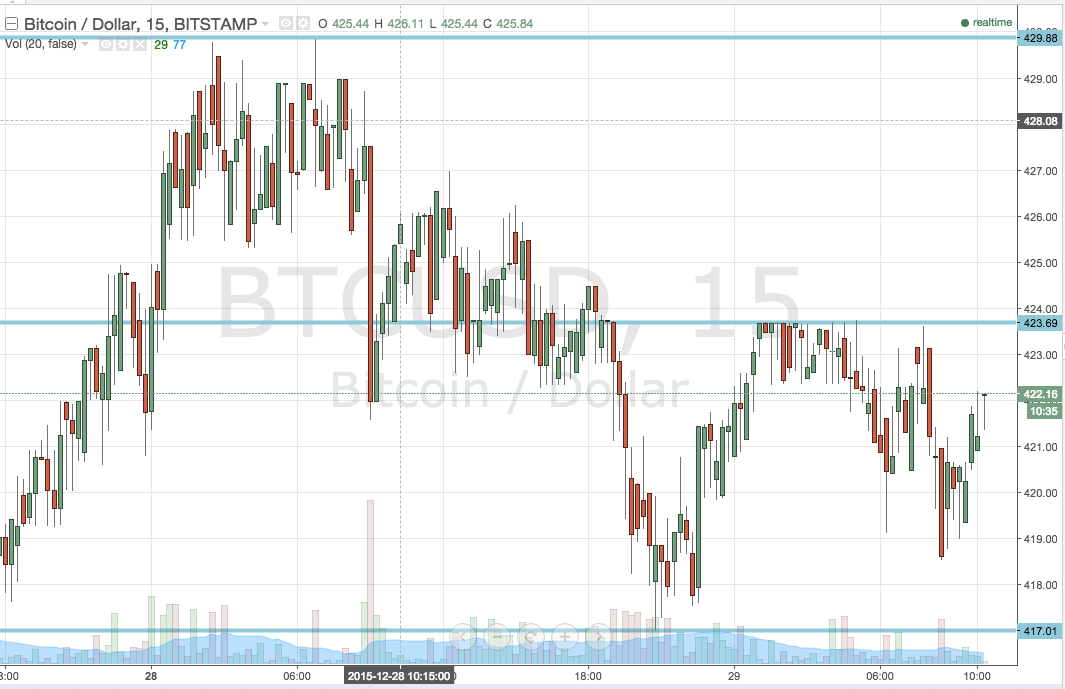

The Christmas period is traditionally pretty subdued across the financial asset markets, and bitcoin is no exception to this rule. Low participation rates weigh on volume, and make it difficult to form any real intraday bias as a result. With low volume comes spikes, and with spikes come breakouts, however, so just because participation might be low, there’s no reason we can’t draw a profit from any action. Financial markets across the globe reopened yesterday (albeit not for a full week with New Years coming up on Friday) and its time to get back into our bitcoin price watch strategy. So, wit this said, and as we head into a fresh day’s trading out of Europe, what are the levels we are keeping an eye on in the bitcoin price today, and where will we look to get in and out of the markets according to our strategy, both from an entry and risk management perspective? As always, take a quick look at the chart to get an idea of what we are watching.

As you can see from the chart, having gained strength throughout the weekend, the bitcoin price hit highs of 430 early yesterday morning, and has since declined to trade within today’s range. In term support comes in at the most recent swing low, while in term resistance sits at the concurrent swing high – 417 flat and 423.69 respectively.

We will look for a break above in term resistance, followed by a close above this level, to put us in a long trade towards the aforementioned highs at 430. On this one, a stop in the region of current levels (circa 421) will maintain our risk profile.

Looking to the downside, a close below support will put us short towards 410 flat, with a stop at 420 keeping things attractive from a risk management perspective.

Charts courtesy of Trading View