Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

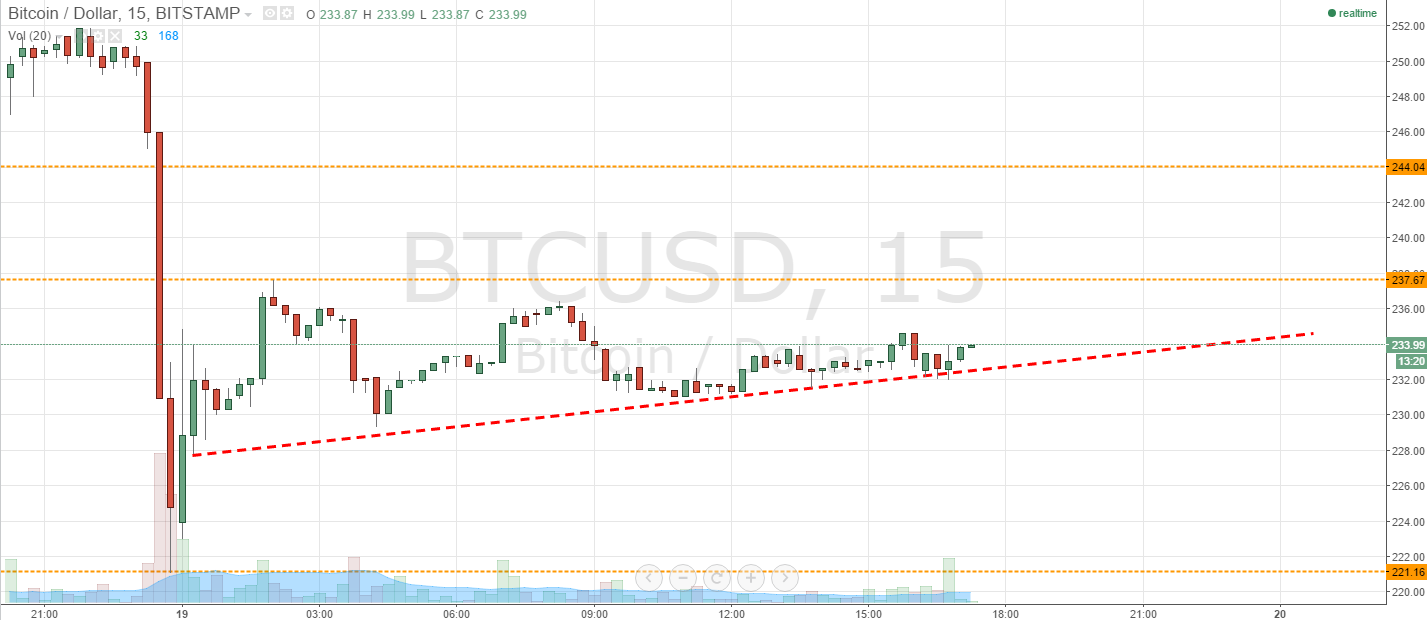

Fundamental opinion seems to be driving the bitcoin price at the moment. We have seen sharp declines in a matter of hours spike the bitcoin price down to fresh weekly lows, and pretty much instant corrections drawback on some of these spikes to cement positions. However, as mentioned this morning, the European session seems to be relatively quiet as far as big moves are concerned. It is almost as if the Asian markets are driving the volatility, while markets are looking at Europe as a consolidatory session. However, this does not mean that we can’t set up against these driving movements in the Asian session. Any consolidation during Europe simply serves to further define our entry and exit parameters, and we can use orders to get in and out by default if need be. So, with this said, here’s what we are looking at this evening. Take a quick look at the chart.

As you see, during today’s session, we have ranged between a lower trendline of the upward sloping triangle and the upper parameter of 237.67 – the latter of which gives us in term resistance this evening. We are looking at quite a wide range from a traditional support/resistance perspective, but we can use the aforementioned upward sloping trendline as our interim support level going forward and traditional support as a downside target.

We will initially look for a break below the trendline (somewhere around 232 flat) to put us short towards 221.16. This is quite a wide trade, so we can use quite a wide stop loss. Somewhere around 240 flat should do nicely.

Looking the other way, if we break back above in term resistance at 237.67, it will put us long towards a medium-term target of 244 flat. A stop loss somewhere around 235.5 should keep things attractive from a risk management perspective on this one.

Charts courtesy of Trading View

So the ole it may go up or it may go down or sideways. I don’t have the foggiest clue witch thing again Sammy? That old chestnut. Really? Why bother to even write such a crap post?