Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

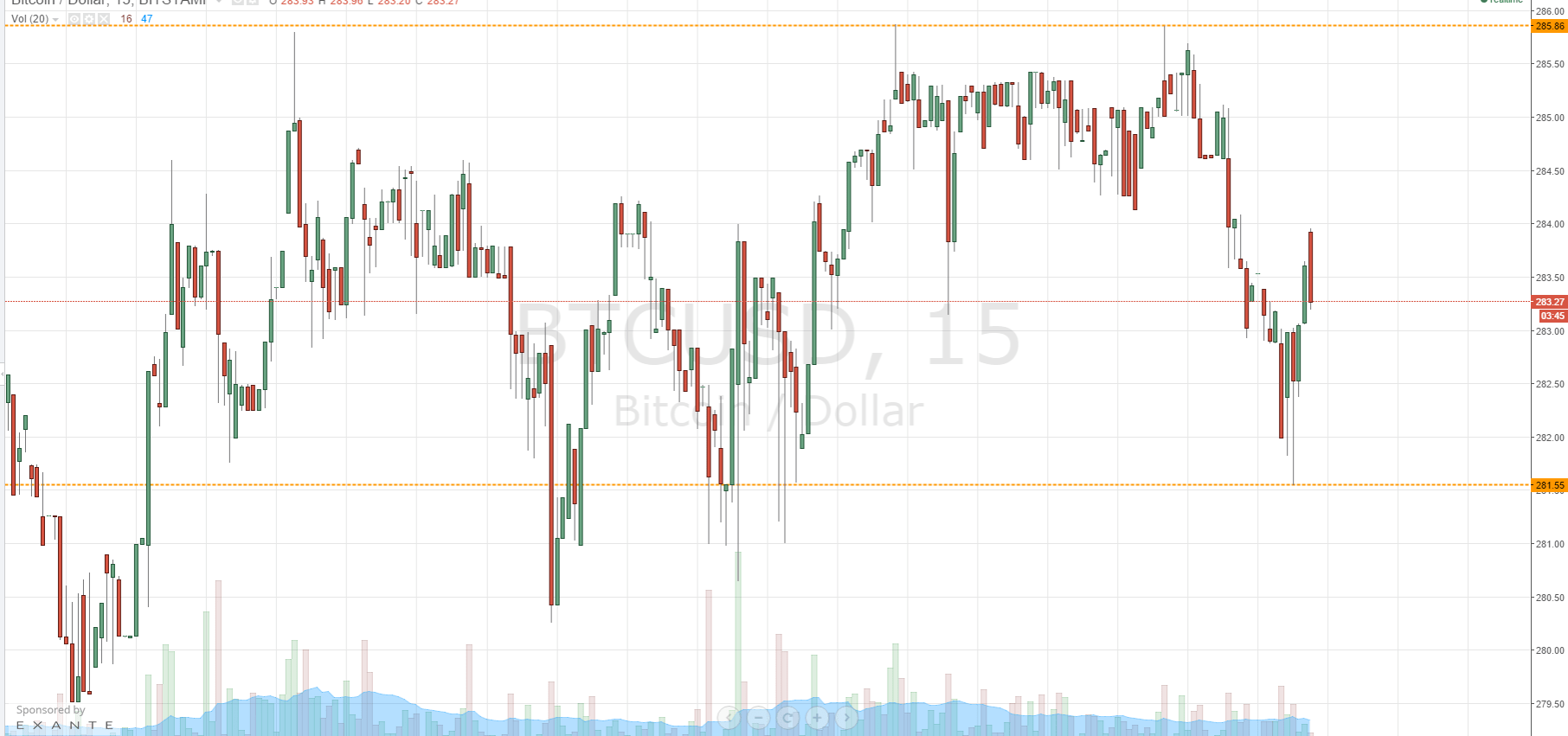

In this morning’s bitcoin price watch piece, we suggested that – if we could get a break above 285 (level we have watched as in term resistance from at least the last week) it would suggest that there could be some further bullish momentum in the bitcoin price as we headed into Friday and – beyond – the weekend. However, we also suggested that the overarching momentum was with the bears, and that during today’s session if we broke to support, we would almost definitely see a continuation of the overarching bearish trend and get some fresh downside targets. As it turns out, the latter of these two incidences has occurred, and we end the day quite a lot lower than the levels at which we began it. So, with this said, what are the levels that we are watching as we head into Thursday evening’s Asian session, and where will we look to get in and out of the markets according to our breakout strategy? Take a quick look at the chart.

At the chart shows, we are currently trading just ahead of the level that serves as in term support at 277.3. This will be the level to watch to the downside this evening. To the upside, 280.65 brings us in term resistance, and gives us one to watch this evening. As we are closer to the bearish side of things at the moment, let’s look at the downside trade first. If we break below in term support, we will look to enter short towards a medium-term downside target of 273 flat. On this trade, a stop loss somewhere around 278 will help to maintain a tight but positive risk reward profile on the trade.

Looking the other way, a break above 208.65 would bring 283.46 into play medium-term. Alternatively, more aggressive intra-range trade, could be to go long from current levels towards in term resistance at 280.65.

Charts courtesy of Trading View