Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

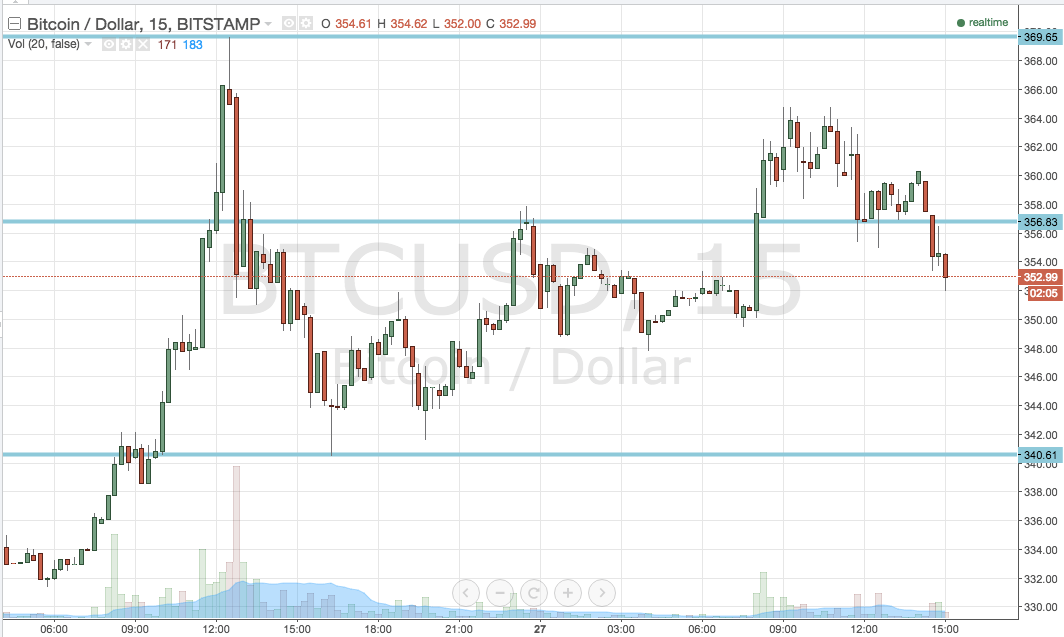

Earlier on this morning, we published the first of our twice daily bitcoin price watch analysis. In the piece, we suggested that – as a result of the width of our predefined range – we would bring both our intrarange and our standard breakout strategy in to play. Action has now matured to the close of the European session, and we are about to head into Friday evening a a fresh Asian session. Many of the markets for the more traditional financial assets close over thanksgiving and the weekend, but not bitcoin. This means we can get our strategy in line for the weekend, and attempt to pull a profit from the markets while the rest of the financial world lays low. So, as we head forward, what are the levels we are watching in the bitcoin price tonight, and what did action today so in relation to our strategy? Take a quick look at the chart below.

As you can see, action today has been pretty choppy. We initially got a bounce from support, which allowed us to enter long according to our intrarange strategy. However, we quickly reversed on the long entry and got taken out of our position on a break below support. We now trade between in term support at 340.61, and resistance at 356.83. These are today’s key levels.

If we get a break back above in term resistance, it will put us in a long trade towards an initial upside target of 369.65. On this one, a stop somewhere in the region of 352 flat will help us to maintain a positive risk reward profile.

Looking the other way, a close below in term support will put us in a short trade towards 335 flat. This is slightly tighter than the long trade, so a stop around 343 will just about keep things attractive from a risk perspective.

Charts courtesy of Trading View