Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In what has been a pretty volatile week for the bitcoin price, we have managed to get in and out of the markets according to our intraday strategy on a number of occasions. However, during yesterday’s action, we were chopped out by considerably despite our tight scalp parameters. As we head into a fresh European session, will get a repeat of the action we saw yesterday, or will the bitcoin price slowdown heading into the weekend? Take a quick look at the chart below.

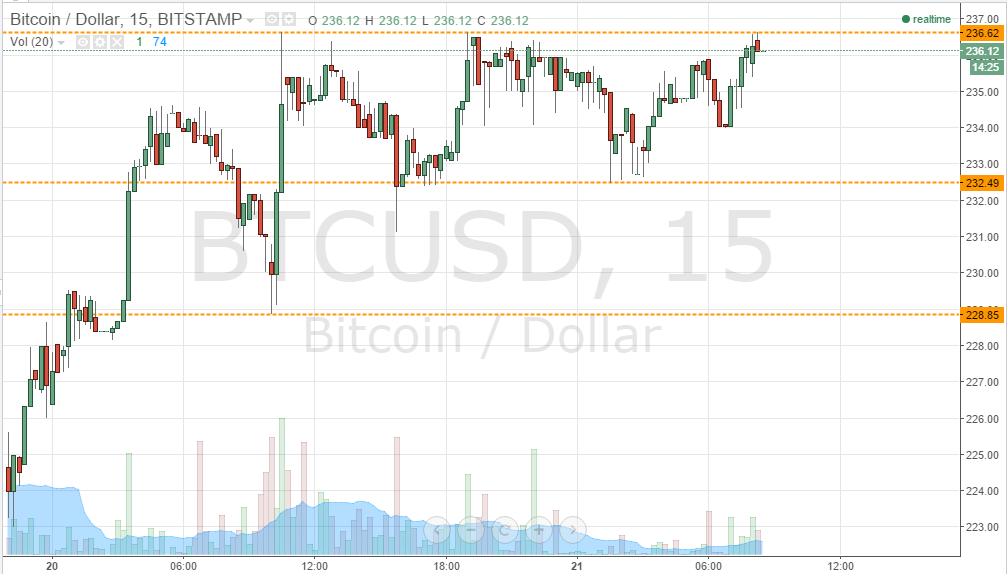

As the chart shows, the levels we are watching today are in term support at 232.49 to the downside, and in term resistance at 236.62 to the upside. These will be the parameters that define our entries and exits during today’s European session.

We are currently trading just short of in term resistance, so we will initially look for an intra-range trade entry, with a medium-term target of in term support at 232.49 and a stop loss just above current levels around 237.5. If we can break above 236.62, it will put us long on a break out trade towards 240 flat.

Looking the other way, a break below 232.49 would instigate a short entry with a medium-term target of 228.85. On this trade, a stop loss somewhere around 234 flat will help us to maintain a positive risk reward profile while still leaving enough room for us to avoid being chopped out in the event that we return to trade mid-range during the day.

Charts courtesy of Trading View

Support line has been breached.