Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

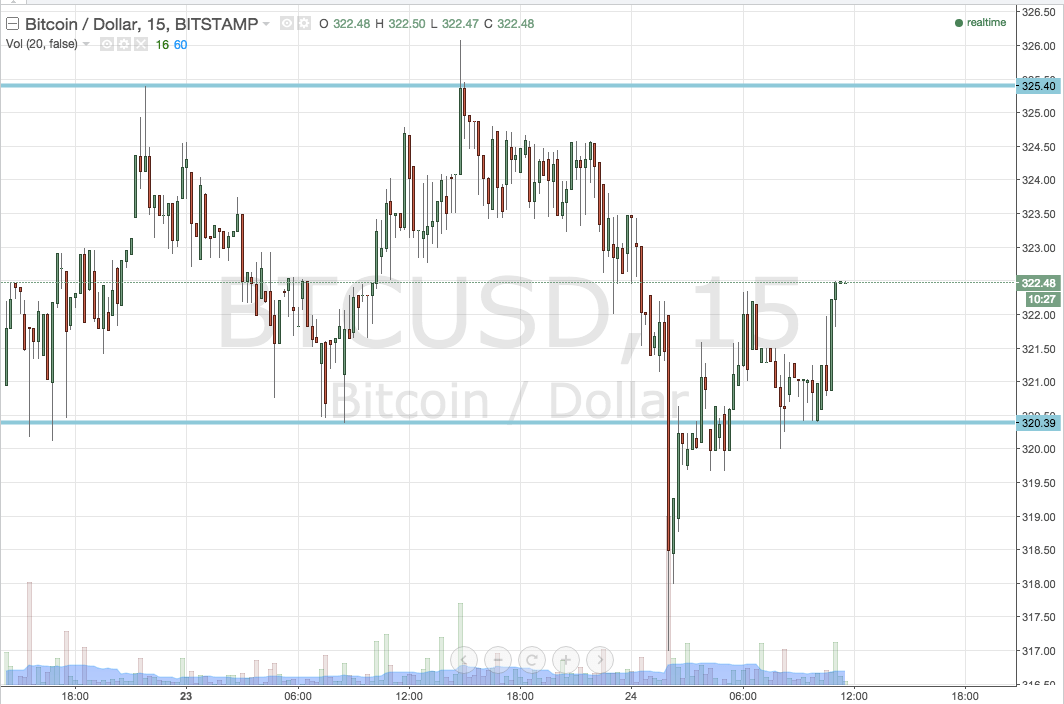

In what turned out to be a pretty unfortunate setup, we entered last night on a breakout to the downside through in term support, with an initial target of 215 flat. This was a target we had predefined, and our entry included a top loss at 322 flat – approximately half of the reward we we looking to capture on the short trade. Having broke support, the bitcoin price ran down towards our target, but at pretty much 317 exactly reversed and quickly changed tact to return to trade within range, and take out our stop in the process. This is, of course, the reason we have stops in place, and the fact that we got taken out of a trade for a small loss is something we must be comfortable with in this sort of approach to the bitcoin price markets. However, in the interest of full disclosure – circa two dollars per lot lost overnight. Now, as we head in to a fresh day’s trading, what are the levels we are looking at in the bitcoin price, and where will we look to get in and out of the markets in an attempt to recoup last nights’ losses? Take a quick look at the chart to get an idea of where we are trading.

As you can see from the chart, and despite last night’s action, we are still watching the same primary levels – in term support at 320.39 and resistance at 325.40. These are the levels we will focus on today.

Breakout in place as normal – if we get a close below in term support it will put us short towards overnight lows of 217 flat. A tight target, so a tight stop is required – somewhere in the region of 321.50 should do the trick.

Looking the other way, a close above 325.40 will put us long towards 330 flat, with a stop around 324 flat defining our risk on the trade.

Charts courtesy of Trading View

“Breakout in place as normal – if we get a close below in term support it will put us short towards overnight lows of 217 flat” 317?