Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

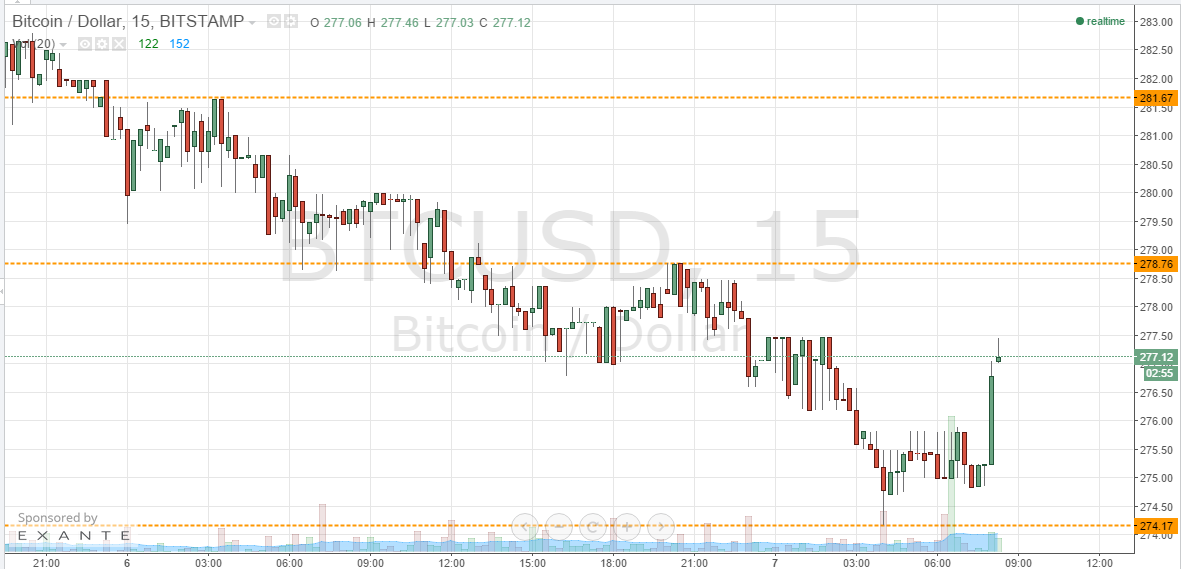

So last night we published our twice-daily bitcoin price and highlighted what we will be looking at throughout the Asian session during Thursday evening. The main topic of conversation was the overarching bearish decline we have seen the bitcoin price over the last few days, and the suggestion that – if we broke in term support – this decline could well continue as we head into the weekend. As it happens, we did get a bit further decline, but during pre-session Friday morning, we have had a little bit of reprieve. So, with this said, what of levels that we are keeping an eye on in the bitcoin price today, and how will we look to get in and out of the markets according to our intraday breakout session on any volatility during the day. Take a quick look at the chart.

As you see, we are currently trading mid-range around 277.12. Our European session range defined by in term support at 274.17 (daily lows) and 278.76 to the upside serving as in term resistance. These are the two levels that we will be watching closely today.

We will initially dealt with the current momentum and look for a break above 278.76. If we can get a close above this level, we will initially go for a target of 281.67 and – beyond that – look to the long-standing 285 as a longer-term goal.

Looking the other way, a break below 274.17 will put us short towards a short-term target of 270 flat, with a stop loss somewhere around 275.5 helping us to maintain a positive risk reward profile on the trade while leaving us enough room to avoid being chopped out in the event that we return to trade within range.

Charts courtesy of Trading View

Down to $266 and looks to drop further, that’s a heavy feline corpse.