Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

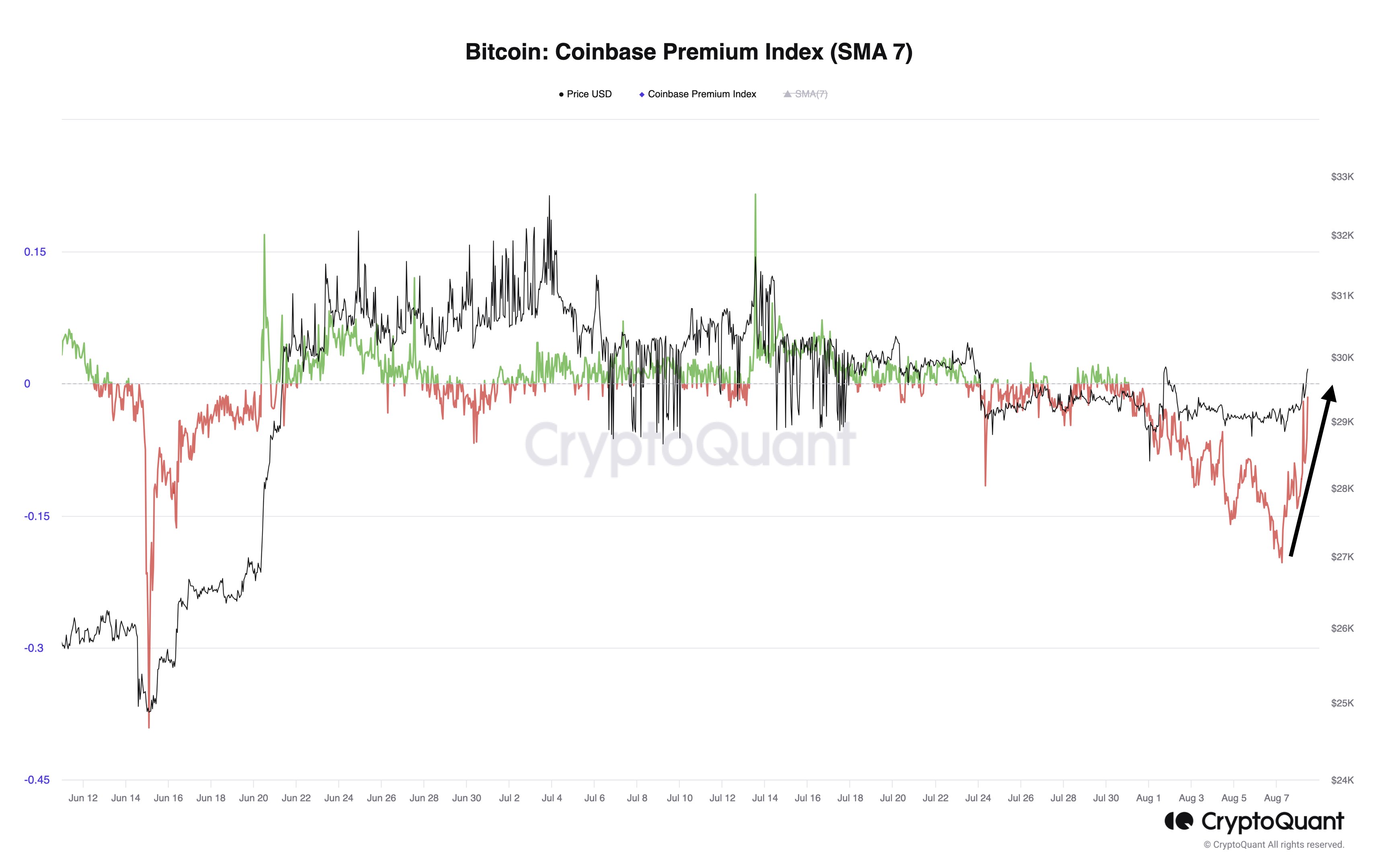

Data shows the Bitcoin Coinbase Premium Index has recently seen a surge, a sign that buying from US investors may contribute to the recovery.

Bitcoin Coinbase Premium Index (7-Day SMA) Has Been Going Up Recently

According to data shared by Julio Moreno, the Head of Research at CryptoQuant, the Coinbase Premium Index has been sharply trending up recently. The “Coinbase Premium Index” here refers to a metric that keeps track of the percentage difference between the Bitcoin price listed on Coinbase (USD pair) and that listed on Binance (USDT pair).

This metric can help us know which platform’s user base is buying or selling more of the asset. For example, when the index’s value is greater than zero, it means that an extra amount of buying pressure has been present on Coinbase, which has pushed the asset’s price up on the platform (or just a lower amount of selling pressure than on Binance is there on Coinbase).

Coinbase is known to be used more heavily by US-based investors (especially large institutional traders), while Binance’s traffic is spread around the globe.

Thus, if more buying is happening on Coinbase, it can be a sign that the US-based investors are participating in more buying than the global traders.

Now, here is a chart that shows the trend in the 7-day Simple Moving Average (SMA) Bitcoin Coinbase Premium Index over the past couple of months:

The 7-day value of the metric seems to have been rising in recent days | Source: Julio Moreno on X

As displayed in the above graph, the 7-day SMA Bitcoin Coinbase Premium Index has only been negative this month, implying that the global investors have either outpaced the US traders in accumulation or the Americans have been selling to a higher degree.

Recently, however, as news has started to come out that the probability of the BTC spot ETFs being approved in the US is increasing, the indicator has turned around and is now heading up.

The metric has sharply increased in the past day, suggesting that the US-based institutional traders may now be participating in some heavy buying.

During this same period, Bitcoin has observed a recovery rally in which the cryptocurrency’s price briefly managed to touch the $30,000 mark before falling back to the current levels.

Naturally, the timing of the rally and the 7-day Coinbase Premium Index sharply going up could imply that the buying from the American holders are providing the fuel for the move.

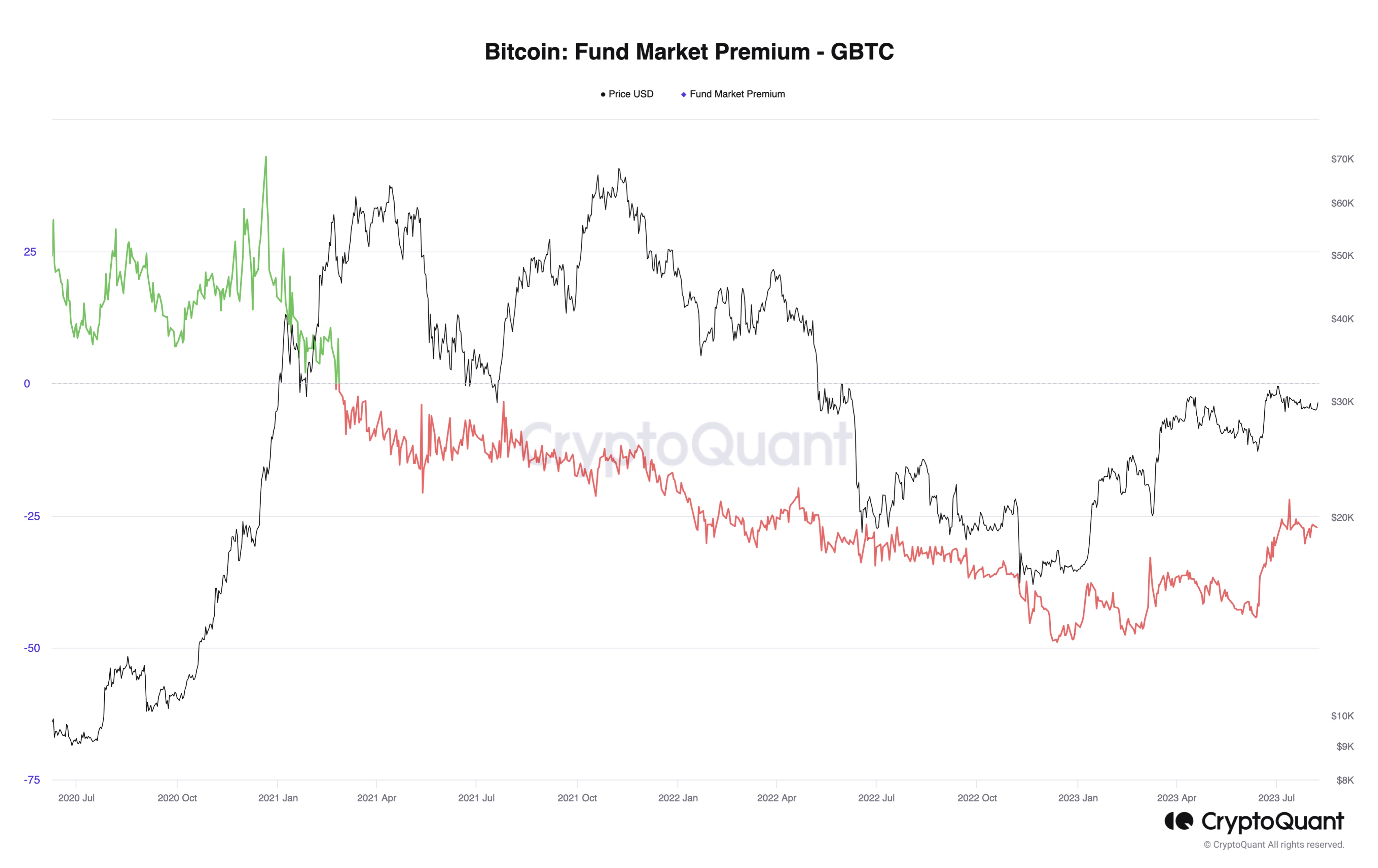

The Grayscale Bitcoin Trust (GBTC) Premium, a metric that checks for whether GBTC is trading at a premium or a discount, has also been trending up recently, implying that the discount on the fund is decreasing (although it’s not near the positive territory yet unlike the Coinbase Premium Index).

Looks like the metric's value is becoming less negative | Source: CryptoQuant

GBTC is a fund that allows users to get indirect exposure to Bitcoin in a way that traditional investors would be more familiar with. Thus, this metric holds hints about the buying or selling activity in which the more conventional US institutional traders are currently participating.

BTC Price

At the time of writing, Bitcoin is trading around $29,800, up 1% in the last week.

BTC has observed some uplift during the past day | Source: BTCUSD on TradingView