Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

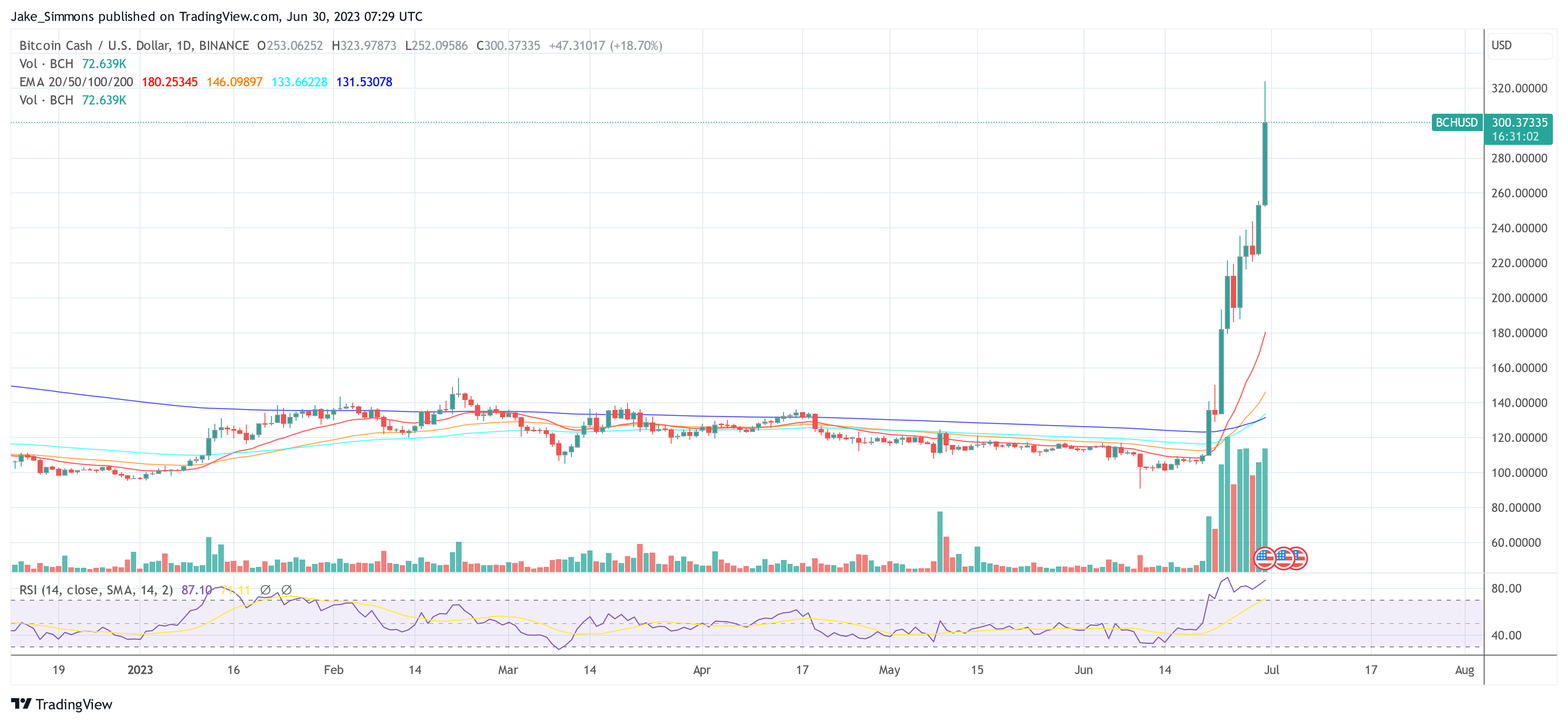

The Bitcoin Cash (BCH) price has gone through the roof in recent days. Within the last ten days, the Bitcoin fork has risen by a staggering 168%, temporarily BCH was already up over 200% today. While Bitcoin Cash was still trading at $104 on June 20 and was stuck in a deep bull market that looked bad even compared to other altcoins, a miracle occurred 10 days ago. The price exploded out of nowhere.

Why Is Bitcoin Cash Experiencing A Revival?

As NewsBTC reported, the reasons for the phenomenal rise in BCH’s price have already been discussed hotly over the past few days. It was often heard that the listing on the new crypto exchange EDX Markets, which is backed by industry giants Citadel Securities, Charles Schwab Corp. and Fidelity Digital Assets, favored BCH.

Furthermore, it has been argued that the price increase is also due to Bitcoin Cash’s recent “game-changing” upgrade. In mid-May, Bitcoin Cash underwent a hard fork that not only improved the network’s security and privacy measures, but also introduced plans for CashTokens.

However, the real reasons for the current Bitcoin Cash pump seem to lie elsewhere: namely in South Korea. Chinese crypto journalist Colin Wu reports today that South Korea could be the reason for the BCH pump, looking at where much of the trading volume originates.

In the last 24 hours, the largest exchange in South Korea, Upbit, recorded over $350 million in trading volume for BCH/KRW, accounting for 23.58% of the total trading volume for BCH. Moreover, it is also three times the trading volume of BTC/KRW on Upbit – an anomaly that has extreme rarity.

Renowned crypto whale and trader Andrew Kang agrees, stating that the current BCH rally reminds him of the multi-week Aptos (APT) battle between Korean retailers and “professional traders.”

Never Skip A Korea Pump?

“Koreans didn’t need a reason to bid, all that mattered is that it kept going up and early bears got slaughtered,” Kang said. The trader is alluding to APT’s 500% rally earlier this year.

South Koreans pumped Aptos because of a joke about housing affordability. APT’s trading volume on the South Korean crypto exchange UpBit was often higher than the total trading volume on Binance at the time. It was also beneficial that the Aptos Foundation marketed the altcoin to Koreans from day one.

According to Alex Shin, co-founder of crypto venture capital firm Hashed, South Korean crypto investors took Aptos’ three-letter ticker “APT” and turned it into a meme alluding to how absurdly expensive it is to buy an “apartment” in South Korea. Asia expert Wu said at the time that “pumping altcoins is a tradition in the Korean community.”

Kang concluded: “People are shorting more BCH than there is liquid supply of it. It’s highly illiquid since most of the supply is dead. Imagine fading the original cartel” and added “disbelief pump.”

At press time, BCH changed hands for $300 per coin.