Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin Cash (BCH) has experienced a remarkable upswing, with its value soaring by 55% in the past week. This surge can be attributed to two key factors: BlackRock’s recent application for a Bitcoin spot ETF with the United States Securities and Exchange Commission and the launch of EDX Markets.

BlackRock’s move to seek SEC approval for a Bitcoin spot ETF has sparked a wave of similar applications, generating a bullish sentiment in the cryptocurrency market. This sentiment has had a particularly positive impact on Bitcoin and related projects, including Bitcoin Cash.

Nonetheless, the introduction of EDX Markets, a platform catering to institutional investors, appears to be the primary catalyst behind Bitcoin Cash’s recent price surge. EDX Markets, backed by industry giants Fidelity, Schwab, and Citadel Securities, carries significant weight despite not being registered with the SEC.

Jamil Nazarali, CEO of EDX Markets, expressed confidence in the compliance of the four listed crypto tokens (Bitcoin, Ether, Bitcoin Cash, and Litecoin) with the SEC. The platform’s selective listing of cryptocurrencies, which includes Bitcoin, Ether, Litecoin, and Bitcoin Cash, has been interpreted as a vote of confidence, specifically in Bitcoin Cash.

The listing of BCH on the EDX Markets exchange is an indication of the token’s regulatory clearance. This interpretation gains significance as the SEC scrutinizes other blockchain projects.

Related reading: Here’s What Caused Bitcoin’s Flash Crash To $29,000

Bitcoin Cash Uptrend Fueled By Volume Spike On Upbit

A major factor that could have influenced the recent uptrend in Bitcoin Cash (BCH) is the short squeeze and an unexpected surge in trading volume on the South Korean exchange, Upbit. A short squeeze occurs when the price of an asset rises, leading traders who had bet against the asset’s price to cover their positions at a loss or face forced liquidation.

The volatility in BCH’s price resulted in approximately $19 million in liquidations within the past 24 hours, with short orders accounting for 77% of the total amount. These liquidation levels represent the highest recorded in June 2023, according to data from Coinglass.

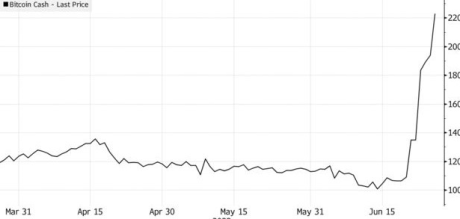

BCH’s price remained heavily suppressed throughout the year, fluctuating between $100 and $150. However, its value experienced a significant vertical rise after being listed on EDX Markets. Currently, BCH is trading at $308.72, reaching levels last seen 14 months ago in May 2022.

According to crypto research outlet The Tie, BCH trading volumes on Binance have reached levels not witnessed in two years. This indicates a resurgence of BCH’s trading interest following its EDX Markets listing. This renewed interest highlights a positive shift in the trading dynamics surrounding Bitcoin Cash.

BCH is trading at $280.7 at press time, with a 5% decline in the past 24 hours.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from iStock and charts from Tradingview, Bloomberg, and Coinglass