Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

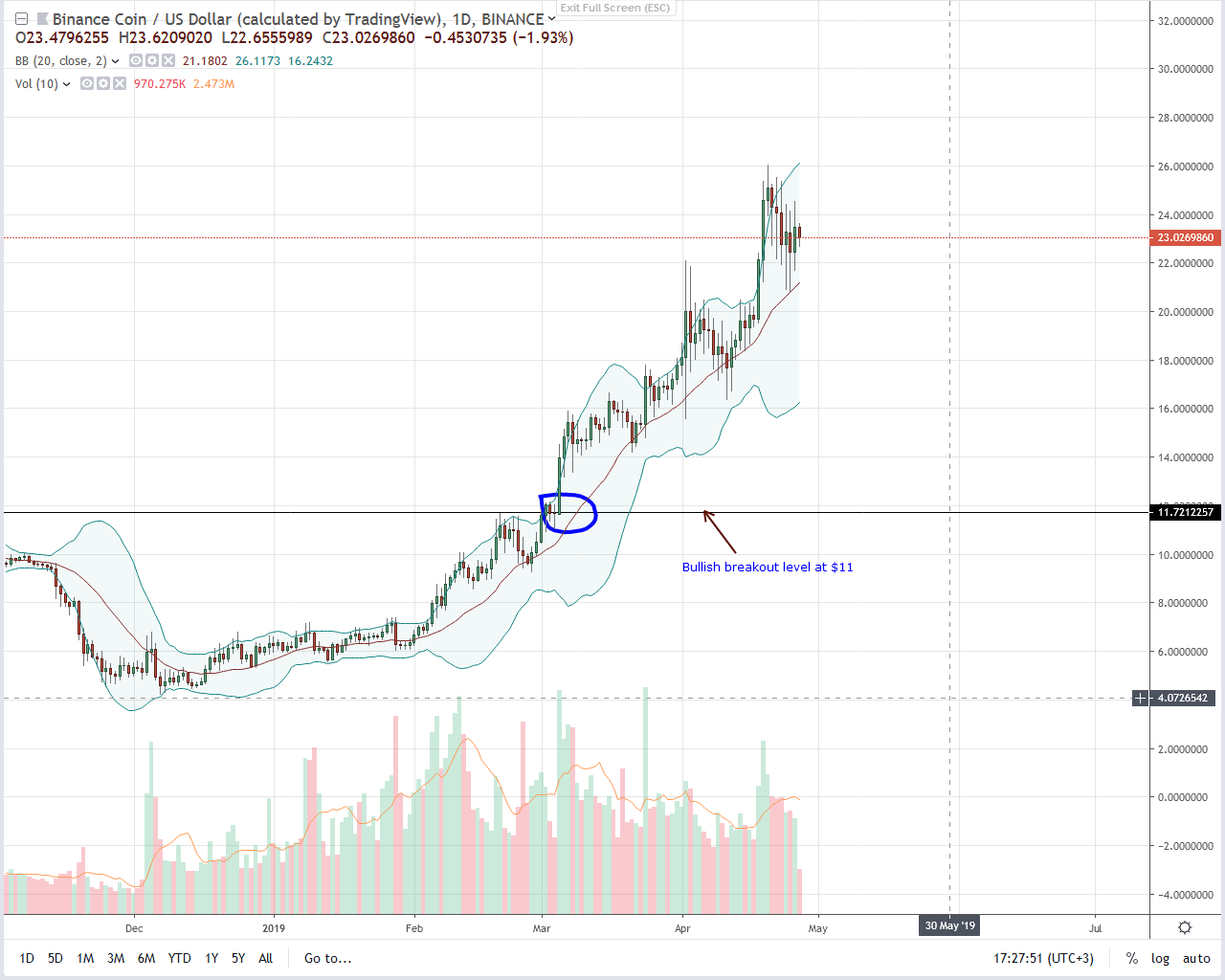

- BNB prices stable but can expand to $41

- Binance fundamentals supportive for BNB

With the launch of Binance chain and Binance DEX, Binance Coin (BNB) could benefit from increasing demand as Binance is one of the few trusted exchanges according to OpenMarketCap. Thus far, it is ranging with support at $20.

Binance Coin Price Analysis

Fundamentals

Simply put, Binance Coin (BNB) is a loyalty coin. Operating from the world’s largest exchange by adjusted volume, Binance, which is less than three years, the coin is a top performer increasing by triple digits in the last five months.

From a fundamental and technical point of view, the coin would likely add more in the coming months if not years. Much has been said about the launch of their DEX and how successful it is. But before succeeding where others are struggling in, Binance must prove that there is sufficient liquidity and is fast enough. That would avert algorithmic trading exploitation while a complementing UX would attract new users confident on security and control of their asset.

Because BNB is the native currency whereby use confers advantages, operation from Binance, Binance DEX and demand from all listed projects willing to raise funds from their Launchpad is overly bullish for the coin. Investor demand is perhaps one of the reasons why Binance Coin is now available in three exchanges including Livecoin. Combine that with quarterly coin burns and FOMO; it’s easy to be confident on the coin.

Candlestick Arrangement

Back to price and after a parabolic rise, Binance coin (BNB) is cooling off. Ranging within a $6 zone with supports at $20—the middle BB and $26, bears seem to be back. Of note is the doubling of price, the inevitable overpricing of Apr-20 and then current correction.

Even so, bulls are in control, and as every dip is another loading opportunity printing out in a clear uptrend, any drop below $20 would temporarily allow sellers to dominate. In that case, it is likely that BNB will hit $16.

On the flip side, any high volume gain blasting above $26 would trigger another wave of higher high that would see BNB test $41 or the 161.8 percent Fibonacci extension level of the coin’s high low.

Technical Indicator

Down 2.8 percent in the last day, guiding Binance Coin price action is Apr-19, a wide-ranging bar, confirming gains of the week ending Apr-6. Since buyers are in charge, effort versus reward analysis indicates that any surge above $26 should preferably be with transaction volumes exceeding averages of 2.5 million and most importantly, 3.7 million of Apr-19.

Chart courtesy of Trading View