Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Avalanche (AVAX) is hardly an exception as the bitcoin market keeps negotiating a sea of uncertainty. A closer analysis reveals a market struggling with contradicting signals, a mix of cautious optimism and underlying anxiety, even while AVAX has shown some resilience relative to its altcoin counterparts.

Bullish Whispers Or A Mirage?

The direction of AVAX is still completely unknown. Although there are some encouraging indicators—such as relative outperformance and pockets of optimistic sentiment—they are offset by worrisome indicators including declining market control and notable decline in trading volume.

Avalanche: Resistance Levels Loom Large

Examining AVAX’s six-month chart exposes a rollercoaster journey marked by abrupt peaks and troughs. This volatility emphasises AVAX’s reliance on particular changes inside its ecosystem and its sensitivity to more general market trends.

AVAX has shown a trend of price swings mixed with similarly sharp corrections during the last six months. After a recent downturn from April’s highs, the altcoin appears to be grouping around the $38 mark right now.

Should AVAX be able to sustain support around the pivotal $35 level, there is likelihood for a northward movement, particularly if a more general bull run materialises in the bitcoin market.

But major opposition looms around $48 and $53 – pricing points AVAX has frequently tested and failed to exceed in past months. A continuous breakout above these levels would indicate a major momentum change that would take AVAX towards the $80 or perhaps $100 barrier by the third quarter.

A Tale Of Two Markets: Where Do Traders Stand?

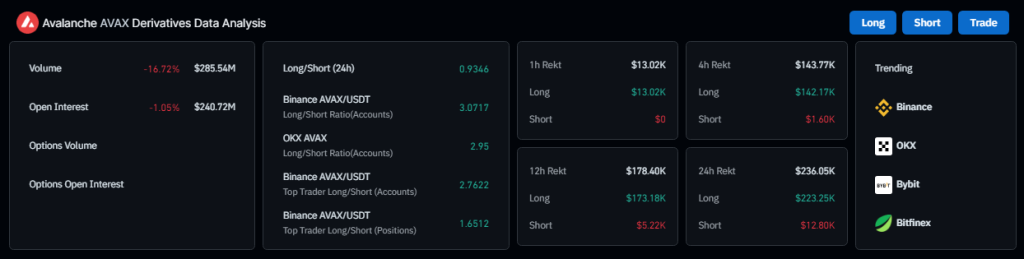

The trade scene around AVAX offers an interesting contradiction. With coinglass data showing a startling 60% drop in trading volume, market activity is clearly declining. A rather balanced long/short ratio across several platforms supports this even further by implying general uncertainty among traders about AVAX’s future.

Still, Binance, a well-known bitcoin exchange, shows some hopeful attitude. Here the long/short ratio is much greater, suggesting a perhaps more hopeful view among individual traders on this particular platform.

With a 40% rating on the Fear and Greed Index, the present situation of the AVAX market is marked by neutral mood, suggesting that investors have mixed opinions.

Losing Dominance, Waning Interest?

The challenges of AVAX transcend mere trading. Search interest is also falling, hence the altcoin appears to be releasing its hold on market share. This results in a lack of market control and maybe declining popular interest – not exactly the formula for success for a token hoping for notable increases.

Featured image from Summitpost, chart from TradingView