Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

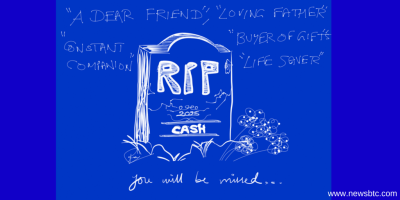

The constantly growing Bitcoin technology could replace cash in Australia within a decade, believes Professor Rabee Tourky, the Director of Research School of Economics at Australian National University.

As per his prediction, the Australian government could one day start minting its own digital currency in this ever-growing digital world. “In 10 years’ time there won’t be any paper cash,” the economist said. “The big question is what’s going to replace it in Australia? Will it be Bitcoin? I don’t think so. More likely it will be ‘AusBit’, an Australian government issued digital cash.”

This would simply mean that the dear cash will have to go at some point, if one already considers its declining use in recent times and tries drawing a futuristic picture out of it. Professor Tourky himself recognized digital cash payments as one of the most emerging, and great experiment of the economy, and therefore decided to include it into their first-year Money and Banking unit.

“ANU economics students typically go into leadership roles, either in government or in the banking sector. In four or five years’ time they are going to be faced with these issues,” he added.

Bitcoin Not an Ideal Prototype

Any new form of payment method attains adoption based on two factors — low costs and secure infrastructure. Australian government will have to administer them both in order to work our a balanced scenario. Bitcoin has indeed proved itself as a cost-cutter; but in terms of infrastructure, its technology still has to go a long way.

Such issues have been well noted by Professor Tourky, who thinks cryptocurrencies are a way too anonymous and private to regulators who wish to monitor their flow. “These are going to be big open questions in economics,” he said. “It’s going to become a major issue for people studying money and banking.”

In the end, we believe that a government will never be launching a centralized cryptocurrency based on Bitcoin’s prototype. There would be a thorough study on how “AusBIt” could be traced when being used for benefiting criminals. Handling this sort of infrastructure might be arduous in terms of cost, but we hope there will be a way by the time we reach 2025, as Professor Tourky predicted.

Bitcoin is for people who value privacy, decentralization (free of any government manipulation) and want to avoid inflationary fiat currency.

To that end it is opposite to fiat and a new asset class of its own – perhaps somewhat like a digital gold except with vast potential uses for efficient financial transactions. If anything it should be thought of as space age credits like in sci-fi, albeit at an embryonic stage.

I agree that some such technology is likley to come into use, and will offer some benefits. But to say cash will be dead in ten years is utter nonsense. Utter nonsense. We will still need cash in parallel with any new system, to cater for the couple of million people out of telecommunications range in Australia at any time; for those unable to use the new system (too old, uneducated, overseas visitor, etc); not to mention the simple things that cash does best, like giving kids money, splitting small bills, putting in your boardshorts pocket when down the beach.

Also, ANU’s description of the system (from half a cent up to anything) suggests it allows someone to be held up in the street at knifepoint, and be forced to hand over their life’s savings – which I’d consider a serious secrity risk.

I am ashamed that my taxes are funding a researcher who is so out of touch with reality that he concludes there will be no cash in 10 years.