Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

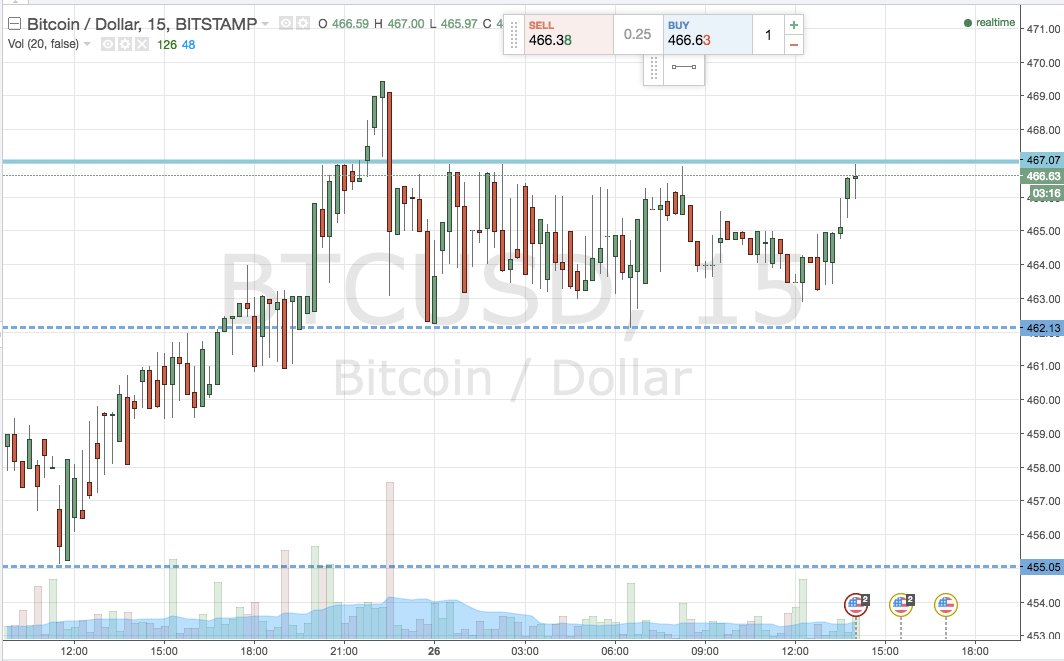

In this morning’s bitcoin price watch piece focusing on today’s session, we noted that as a result of action overnight, we would be tightening our range, and approaching the market with a pure breakout strategy (rather than a combination of our breakout and our intra-range approaches). Action has now matured across the European morning session, and we are about to head into the US afternoon and beyond that – into the Asian session tonight. With this in mind, and as we move forward into the aforementioned periods, what levels are we focusing on in the bitcoin price, and we do we hope to get in and out of the markets according to our strategy if the volatility offers up this option? As ever, take a look at the chart below. It shows action across the last 24 hours, and has the revised range overlaid.

As the chart shows, we’re going to keep in term support as it was, but narrow our range even further by bringing resistance down a little to the most recent swing high at 467 flat. In term support, as mentioned, remains as is, and comes in at 462 flat. It’s just a five dollar range, so probably not big enough to bring our intra-range into play.

So, here’s how we are looking at things. A close above support on the intraday charts will signal a long entry towards an initial upside target of 472. A stop loss on this one somewhere in the region of 464 will serve to maintain a positive reward profile on the trade.

Looking short, a close below support signals a short entry towards a target we selected as one to watch early this morning – 455 flat. Again, we need a stop loss to manage our risk on this one. It’s a slightly more aggressive trade than the previous long entry, so we’ve got a little bit more room to play with when it comes to risk management. With this in mind, a stop loss around 465 flat defines our risk and still gives us enough room to avoid a chop out on the entry.

Charts courtesy of Trading View.