Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin, the world’s leading cryptocurrency, has experienced a noticeable decline in its price over the past two days, dropping from a high of $63,000 to as low as $57,000. This decrease can be considered as unexpected as it surprised many.

So far, crypto analysts are reassessing their outlook on Bitcoin. Despite no hope of a bullish catalyst in sight, some analysts believe this ongoing plunge could be a temporary setback in a larger bullish trend.

Bitcoin Decline Suggests A Setup For Massive Rally?

Renowned crypto analyst Javon Marks recently shared his updated perspective on Bitcoin, suggesting that the recent dip may be a short-lived pullback rather than the start of a prolonged downtrend.

According to Marks, Bitcoin exhibits several bullish patterns that point towards a recovery back to the $65,000 level. He emphasizes that while the current drop is significant, the broader market structure remains intact.

Marks highlighted that one of the bullish patterns seen in Bitcoin’s near-term chart indicates a potential reversal that could lead to a recovery above $65,000.

He further elaborated that on a larger scale, another bullish formation suggests a possible 21% increase from the current levels, potentially pushing Bitcoin’s price to over $73,000. This optimistic outlook is based on historical patterns and technical indicators that suggest Bitcoin may be gearing up for a strong rebound.

One of multiple #Bitcoin (BTC)’s bullish patterns in the near term is present here, suggesting the recent pullback to be temporary and a recovery back to the $65,000s!

On a larger scale, another bull pattern continues to suggest an over 21% climb from here to $73,000+… https://t.co/sDVnmZbkIo pic.twitter.com/4k1rJV5EYU

— JAVON⚡️MARKS (@JavonTM1) August 28, 2024

Was The Dip Something Out Of Ordinary?

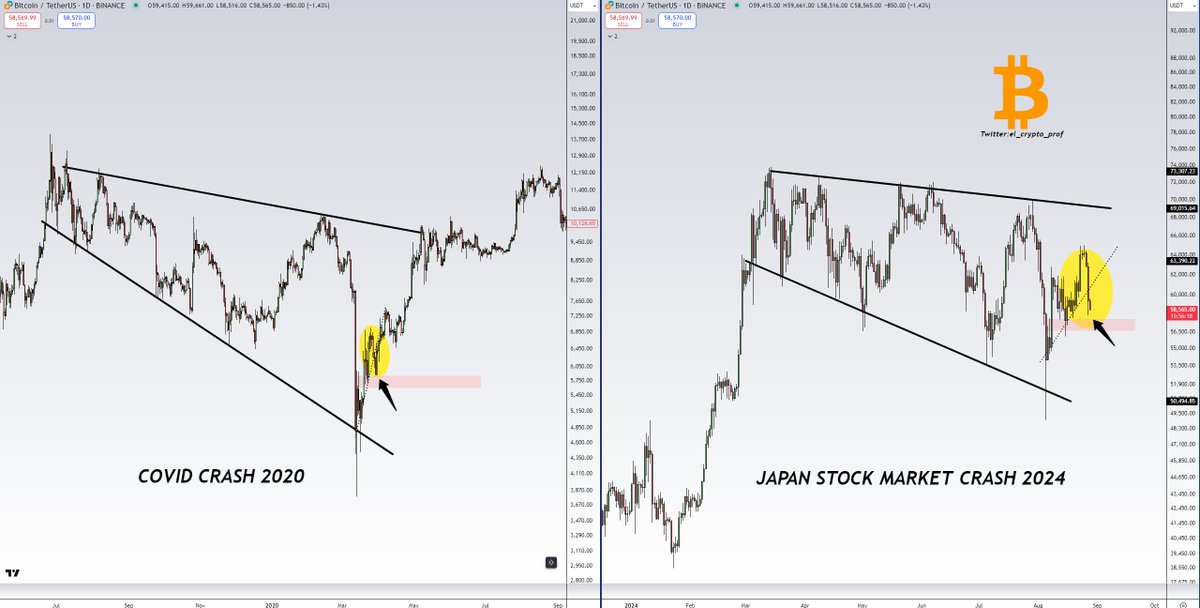

While some investors may be anxious about the recent downturn, other analysts encourage calm. Moustache, a well-known figure in the crypto analysis community, compared the current market situation to Bitcoin’s performance during the 2020 COVID-19 crash.

He pointed out that the current decline resembles the market behavior observed during that period, eventually leading to a significant recovery.

Moustache shared charts comparing the 2020 COVID crash with the ongoing market performance in 2024, particularly focusing on the similarities between Bitcoin’s price action during these two periods.

He noted that, despite the short-term volatility, Bitcoin’s price movements in 2024 appear to be following a similar pattern to the 2020 recovery. According to Moustache, this is a positive sign that suggests Bitcoin could soon rebound, mirroring the post-crash surge seen in 2020.

Featured image created with DALL-E, Chart from TradingView