Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Arthur Hayes, the co-founder of BitMEX and principal of Maelstrom Capital, contends that the US Treasury—rather than the Federal Reserve—is the true engine of the current bull market in risk assets, Bitcoin foremost among them. Speaking in a live-streamed one-on-one interview Wednesday evening, Hayes argued that traders should “ignore Powell” and instead parse every word and data table that comes out of the Treasury’s quarterly refunding announcement.

“Powell hasn’t really mattered for many years,” Hayes insisted, dismissing the Fed chair’s decision to leave the federal-funds rate at 4.25 % to 4.50 % for a third consecutive meeting. “The real show is at the Treasury Department. […] Listen to Bessent. Ignore Powell. He’s irrelevant.”

Hayes’s thesis rests on a liquidity dynamic that first surfaced in the third quarter of 2022. Then-Treasury Secretary Janet Yellen, he said, spotted “two-and-a-half trillion dollars of excess money sitting in the Fed’s reverse repo facility” and shifted issuance toward short-dated Treasury bills. That maneuver, by Hayes’s calculation, siphoned dormant cash out of the Fed and “injected it into the global money markets,” seeding a broad rally that lifted equities, bonds, gold and—most forcefully—crypto. “Powell didn’t matter in 2022 under a Democratic regime,” he said. “He doesn’t matter today under the Republican regime.”

Treasury Secretary Scott Bessent’s newly minted authority to conduct buybacks is, in Hayes’s view, the next accelerant. Buybacks would allow the Treasury to recycle on-the-run securities and absorb supply shocks without forcing the Fed to expand its balance sheet overtly. “Bessent has tools,” Hayes noted, citing an April 11–12 Bloomberg appearance. “Powell will sit back and say ‘I’m going to look at data,’ but he’s a sideshow.”

Bitcoin’s Macro Logic

Hayes reduces the trading implications to a single variable: the quantity of fiat dollars in circulation. “If there is a bigger quantity of fiat dollars in the world than there were yesterday, Bitcoin and crypto will do well,” he said. Price-stability debates, exchange-rate gyrations and even the trajectory of the US Dollar Index (DXY) are secondary. “Bitcoin doesn’t care. All we care about is: Is there more dollars in the system today than yesterday?”

That framework underpins his long-running forecast that Bitcoin can reach $1 million before 2028. The target is deliberately round—“We’re humans, we’re dumb, let’s just pick a round number that’s big”—yet Hayes grounds it in compounding fiscal pressures.

Interest on the US national debt was the fastest-growing line item in the most recent Treasury Borrowing Advisory Committee presentation; Social Security, Medicare and defense costs, he argued, will only push borrowing needs higher. “There’s just no way the US government is going to stop spending money,” he said, adding that he expects “an acceleration of money printing and fiscal debasement” once Powell’s term expires in May 2026.

Asked how he is allocating capital, Hayes said about 60%–65% of his liquid portfolio is in Bitcoin, 20% in Ether, with the remainder in a handful of what he called “quality shitcoins.” He highlighted three projects—Pendle, EtherFi and Ethena—as examples of what he calls “fundamental season,” protocols that generate real revenue and share it with token-holders.

The timing of a broader rotation into altcoins, he added, will depend on Bitcoin dominance. “I think we need to get above 70% before we start seeing a rotation back into alts,” a threshold he tentatively places in the $110,000–$150,000 BTC price range.

Hayes was skeptical that the US–China tariff confrontation will meaningfully shrink the bilateral trade gap. Both sides, he said, need a “face-saving announcement” for domestic audiences, but the United States will continue importing Chinese goods, whether directly or through third-countries. Over time, he expects Washington to rely less on tariffs and more on capital-account measures—such as user fees on Treasuries held by foreigners—to re-engineer trade flows without asking US consumers to “buy less stuff.”

A weaker dollar, in his model, is a by-product of those adjustments, not a centrally planned objective. “If foreigners sell less things in dollars and those dollars are not invested in the financial markets, the dollar will go down in value,” he said. That, again, feeds the Bitcoin bid.

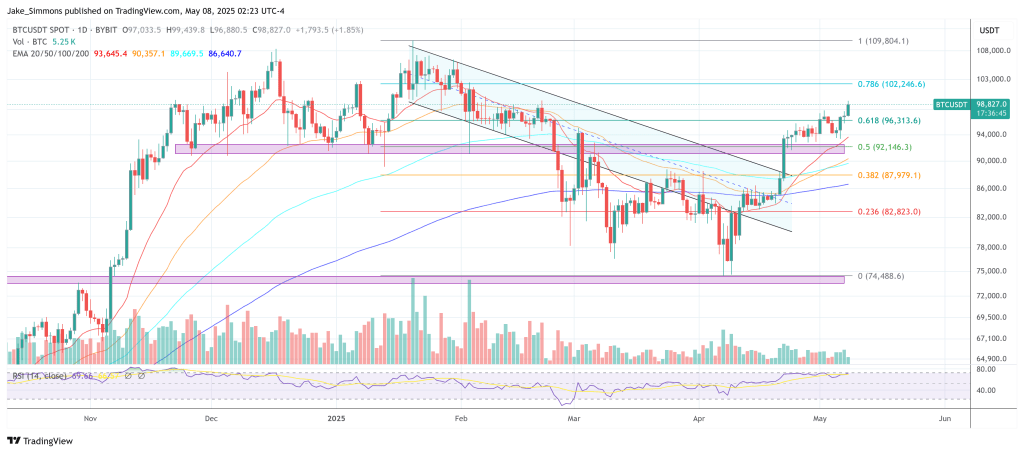

At press time, BTC traded at $98,827.