Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Former chairman and co-founder of CoinRoutes and now president of BetterTrade.digital Dave Weisberger used a November 11 video to restate Bitcoin’s long-term bull case, arguing that the market’s “morose” sentiment and technician-driven calls for downside are missing the structural shift underway on both fundamentals and market microstructure.

He framed his analysis in two parts—why Bitcoin is being bought and what the current market structure implies—contending that the thesis toward seven-figure pricing remains intact even without an obvious near-term catalyst.

The Path To $1 Million Per Bitcoin

On fundamentals, he drew a direct comparison with gold’s monetary role and size. Citing an above-ground market value of “around $28 trillion” and “about $7 trillion in known reserves below ground,” Weisberger argued that roughly 80% of gold’s value is monetary, not industrial, using the platinum–gold price relationship as a proxy.

“Gold today trades at about two and a half times platinum, which for most of my life was about double the price of gold,” he said, adding that platinum is “30 times rarer and more valued by women in jewelry.” From that relative-value lens, he estimated gold’s “monetary value fully diluted around $28 trillion,” contrasting it with Bitcoin’s “fully diluted market cap […] just over $2 trillion at today’s prices.”

If Bitcoin equals or surpasses gold on monetary characteristics, he argued, the gap implies transformative upside: “It could rise to equal gold. Except it’s better than gold on monetary characteristics.” He emphasized Bitcoin’s native digital finality, resistance to counterfeiting, divisibility, transparency, and programmatic supply schedule—benefits that also avoid gold’s custody, assay, and transport frictions.

Even in a scenario where fiat “holds its value,” he suggested, network adoption alone could warrant a multi-fold repricing; in a debasement regime, he said, the asymmetry is stronger: “As the Bitcoin network grows and it gains acceptance it’ll likely rise by 10 times this or more.” Via X, he added “the Fundamental case” is $1 million in today’s dollars.

Weisberger revisited the “fastest horse” framing popularized in the early COVID-era liquidity surge. He pointed to Paul Tudor Jones’s thesis in “May of 2020,” acknowledging he misspoke initially, and reminded viewers that the price then “did nothing” for months before a stepwise acceleration from October through the subsequent euphoric leg higher. The lesson, in his view, is that market tone can lag fundamentals until positioning resets and liquidity leadership rotates back to Bitcoin. “History doesn’t always repeat, but it can sometimes rhyme,” he said.

On market structure, Weisberger took aim at the four-year halving cycle as a predictive template. Historically, he said, cyclical behavior followed a pattern—halving, a six-month period of miner-incentive doubt, then a relief-to-euphoria rally that later bled into altcoin rotation before a broad drawdown.

He argued that dynamic is losing relevance because supply changes are now “irrelevant relative to the amount of demand that’s going on,” while network security trends tell a different story: “If you look at the Bitcoin hash rate chart, it’s increasing at a geometric pace.” The moving parts he sees actually driving prices are the interaction of legacy supply and institutional demand. “It’s basically the OG sellers who are selling over 100,000 [BTC] and the new buyers, whether they’re in ETFs or in MicroStrategy, etc.”

Those early holders, in his telling, are rationally diversifying life-changing gains rather than capitulating, which implies a finite overhang: “Entrepreneurs don’t generally sell everything […] they sell some at a level to get where they need to be and then […] sell at later prices.”

He underscored that spot ETF investors appear patient despite recent volatility. “Even after all of the carnage of the last few weeks since October 10th, less than 2% of the Bitcoin ETFs have outflown,” he said, characterizing that cohort as long-horizon allocators “looking for a 10x gain,” not trading around single-digit drawdowns.

He contrasted October’s deleveraging—“$20 billion was liquidated […] but only five billion of the liquidation was in Bitcoin”—with the 2022 insolvency cascade: “This cycle doesn’t have a Celsius […] doesn’t have an FTX. The impact of the liquidations is not going to be to cause an insolvency event which causes forced sales.”

Without a credit-driven unwind, he argued, technical analogies to 2022 are misplaced: “If there’s no forced sales, why do we expect a sale on the magnitude that happened in 2022 […]? They’re trying to impute something without taking into account the actual circumstance.”

Price leadership, in his view, will return through “liquidity and slow grinding growth” while “hot money” recovers from leverage-driven losses. He expects the OG selling to “abate,” as partial profit-taking runs its course, setting the stage for the next euphoric leg once a catalyst emerges.

Weisberger did not pretend to know which spark will ignite it—“I’m not a Nostradamus”—but listed plausible vectors that are consistent with prior cycles: “The catalyst could be sovereign accumulation. The catalyst could be Bitcoin being used as collateral […] It doesn’t really matter what the catalyst is.”

The key risk for would-be sellers, he suggested, is time out of the market during the inflection: “Unless you are very nimble, very quick, have no tax consequences, and aren’t out of the market or on vacation in the two or three days when euphoria first starts, then I would be very, very reticent to sell here.”

My 2 part Bitcoin analysis:

1) The Fundamental case for $1 Million Bitcoin in TODAYS dollar

2) Why the current gloom is unwarranted & now is a great time to accumulate Bitcoin for the long haul

The Bull Case For Bitcoin 11 11 https://t.co/0ACKrn3bgQ via @YouTube

— Dave W (@daveweisberger1) November 12, 2025

He closed with a caution that acknowledges the market’s capacity to frustrate both bulls and bears. “Maybe euphoria will happen after it continues to drag on and fall for another few months, but at some point it will happen,” he said. He disclosed his positioning—“I have not sold any sats, nor do I intend to”—and reiterated the discipline required in a choppy tape: “Stay safe out there. This market does look interesting and is going to likely stay that way for a while.”

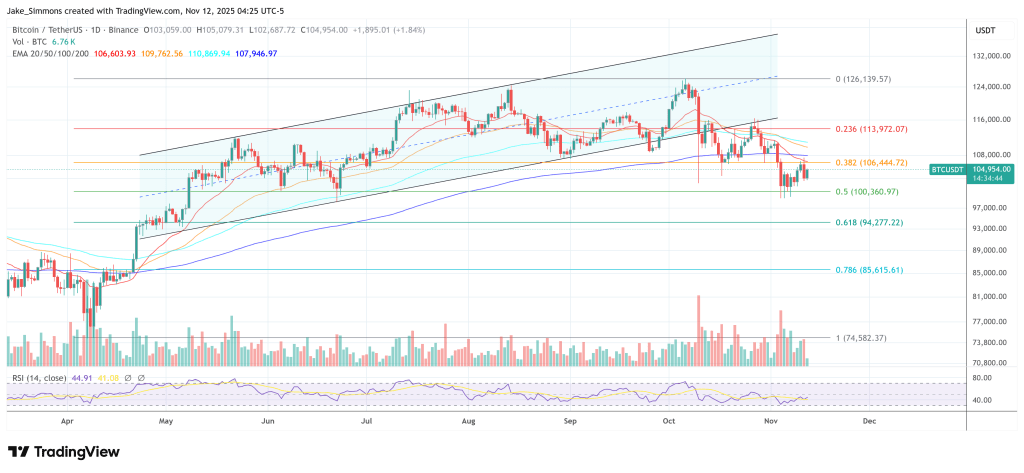

At press time, BTC traded at $104,954.