Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s options market has a new obsession: Christmas week. In a post Thursday, energy-sector managing partner David Eng argued the next eight days (December 19 through December 26) could define the near-term cycle for BTC, not because of a macro headline or some sudden ETF stampede, but because a large chunk of dealer gamma exposure is scheduled to roll off the board in two shots.

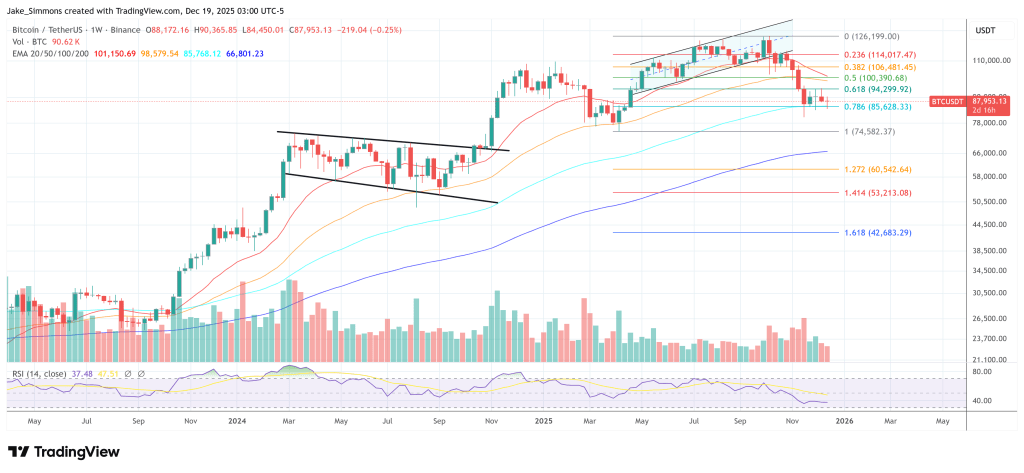

At press time, bitcoin traded around $86,928, after swinging between roughly $84,461 and $89,230 intraday. Eng’s framing is blunt and very “options people”: the market is being mechanically pinned, and the pin has an expiry date

The Hidden Force Holding Back Bitcoin Price?

“The narrative isn’t just about tomorrow. We are staring down the barrel of a ‘Double-Barreled’ Liquidity Event that will wipe 67% of the entire derivatives board clean by December 26th,” Eng wrote. “Bitcoin is trading at $88,752, deep in the -25% Value Zone (Trend Value: $118k). The spring is coiled, but two massive structural weights are holding the lid down.”

Those “weights,” in his telling, are two expiries with meaningful gamma attached: roughly $128 million tied to Dec. 19 (21% of the total he tracks) and another $287 million at Dec. 26, which he calls the “boss level” ceiling. He labels the combined $415 million a coming “Gamma Flush,” arguing that once it clears, the hedging drag that’s been compressing spot price action should ease.

The practical point is less mystical than it sounds. If dealers are sitting on meaningful gamma around a tight cluster of strikes, their delta-hedging can dampen volatility and keep spot gravitating around certain levels until that exposure decays or expires — the kind of “why does this tape feel glued?” frustration traders know too well.

Eng’s map is built around very specific lines in the sand: $85k–$90k as the “mud” zone where hedging pressure keeps snapping price back, and $90,616 as the flip level he’s watching around the Dec. 19 expiry.

“Stage 1: The Spark (Tomorrow, Dec 19) — $128 Million in Gamma expires tomorrow (21% of total). This is the ‘Appetizer.’ It removes the immediate suppression pinning us below $90k,” he wrote. “Watch the $90,616 flip level. If we clear this, the intraday shackles fall off.”

But Eng is clearly more focused on the week after. “Stage 2: The Floodgate (Next Friday, Dec 26) — $287 Million in Gamma expires next week,” he continued. “A staggering 46.2% of all dealer gamma exposure sits on this single date… Dealers have a quarter-billion-dollar incentive to keep volatility crushed and price pinned near $85k-$90k through Christmas to harvest this premium.”

The claim, basically: pre-Dec. 26 is “thick mud,” post-Dec. 26 is the tape suddenly breathing again. “When you combine these two dates, $415,000,000 of gamma — two-thirds of the entire market structure — evaporates in the next 8 days,” Eng wrote. “Before Dec 26: The market is fighting through thick mud… After Dec 26: The mud dries up. The suppression mechanism is gone. The Power Law gravity ($118k) takes over without the dealer counter-flow.”

He also tossed out a provocative ratio that’s been circulating in derivatives circles all year: dealer mechanics versus ETF demand. “Dealer Gamma forces are currently ~13x stronger than ETF Flows,” he wrote. “Dealer ~$507.6M, ETF ~$38M. This is why the market is obeying the technical gamma levels ($85k/$90k) and ignoring the ETF volume.”

Dealer Gamma forces are currently ~13x stronger than ETF Flows

Dealer ~$507.6M

ETF ~$38MThis is why the market is obeying the technical gamma levels ($85k/$90k) and ignoring the ETF volume.

— David 🇺🇸 (@david_eng_mba) December 18, 2025

And when critics in the replies questioned whether “$287M” is even meaningful, Eng clarified what the figure is — and what it isn’t. “The $287M figure refers to dealer gamma exposure (GEX), not total options size,” he wrote. “GEX measures how much spot Bitcoin dealers may need to buy or sell to stay delta-neutral as price moves. It reflects hedging pressure, not notional value.”

So the tradeable implication of Eng’s thesis is straightforward: expect the pinning games into Christmas, then watch whether a post-expiry regime shift actually shows up in realized volatility — and in price’s ability to stop bouncing off the same levels like it’s hitting invisible glass.

At press time, Bitcoin traded at $87,953.