Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Hyperliquid (HYPE) has had a turbulent week as the broader altcoin market faces intense selling pressure. After weeks of steady growth, the token is now testing key support levels, with bulls struggling to regain control. Despite the ongoing correction across the crypto landscape, sentiment around Hyperliquid remains mixed — while traders brace for more downside, some optimistic analysts see potential for recovery in the coming weeks.

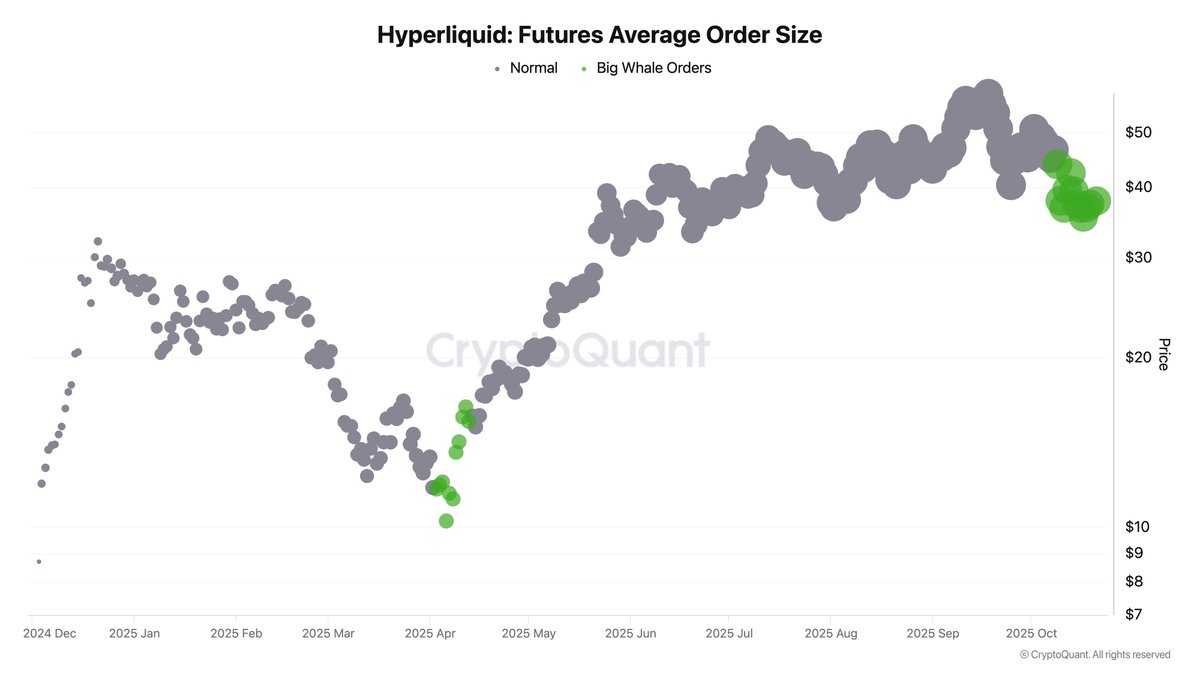

According to fresh data from CryptoQuant, whales are going long on HYPE, signaling renewed confidence among large investors even as retail sentiment weakens. These whale moves often mark the early stages of a rebound, especially when they occur during heightened volatility. Analysts note that such positioning can indicate that smart money is preparing for a potential market reversal, or at least for a relief rally once selling pressure cools off.

Still, the short-term outlook remains uncertain. With the market environment dominated by fear and liquidity thinning out, Hyperliquid’s price action in the coming days will be critical in determining whether it can hold its current support zone or if another leg down awaits. For now, all eyes are on whale behavior — and what it might be signaling next.

Big Players Bet on a Hyperliquid Rebound

Altcoin data analyst Kate Young Ju shared fresh insights into Hyperliquid’s futures market, revealing that the average order size has significantly increased, signaling that large investors — or “big players” — are positioning for a potential price surge. According to the data, institutional-scale orders have become more frequent over the past week, a clear indication that market participants with deep capital are starting to take calculated long positions despite the ongoing volatility.

This comes after a remarkable year for Hyperliquid, which has rapidly emerged as one of the most innovative decentralized perpetual exchanges in the market. Built on its own high-performance Layer 1, Hyperliquid has attracted both traders and liquidity providers through features like zero gas fees, fast settlement, and native HYPE staking rewards. Since its early 2025 rally, the protocol has seen exponential growth in trading volumes and community engagement, solidifying its position among top DeFi derivatives platforms.

The rise in futures order size reflects growing confidence that HYPE may recover from its recent drawdown. Historically, such activity often precedes a reversal, as whales and sophisticated traders tend to accumulate during market uncertainty. This accumulation phase suggests a potential shift in momentum — where smart money is preparing for the next leg up while retail sentiment remains cautious.

If Hyperliquid’s price action stabilizes and macro conditions improve, this whale-driven accumulation could act as the foundation for a strong rebound phase. However, analysts warn that a lack of follow-through from retail traders or a broader crypto selloff could still dampen short-term momentum. For now, the data paints a compelling picture: big players are quietly betting that Hyperliquid’s story isn’t over — it might just be entering its next major chapter.

HYPE Analysis: Testing Key Support After Weeks of Volatility

Hyperliquid (HYPE) is currently trading around $35.6, down more than 6% on the day, as the token continues to face heavy selling pressure. The daily chart reveals that HYPE has entered a critical support zone near the 200-day moving average (red line), which sits around $34–$35. This level has acted as a strong base during previous corrections, particularly during April and July, when similar pullbacks led to renewed bullish momentum.

However, price action has weakened notably after failing to reclaim the 50-day moving average (blue line) near $42, turning it into short-term resistance. The series of lower highs and sharp rejections from this zone highlight a market struggling to regain confidence.

On a broader view, HYPE remains in an uptrend, but the structure is under pressure. If the token manages to consolidate above $35, it could attract buyers aiming for a rebound toward the $40–$42 area. Conversely, a breakdown below $34 could accelerate losses toward $28, the next significant support level.

Featured image from ChatGPT, chart from TradingView.com