Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Trend reversals can unwind extremely slowly, or happen sharply as a strong rejection. Traders must be ready for anything.

Some technical analysis indicators can tip traders off to when assets reach oversold or overbought conditions. This is often a sign that a trend may soon be turning.

Certain chart patterns and candlesticks also can signal a reversal is near. When watching for reversals, however, paying attention to a surge in volume is critical to confirmation.

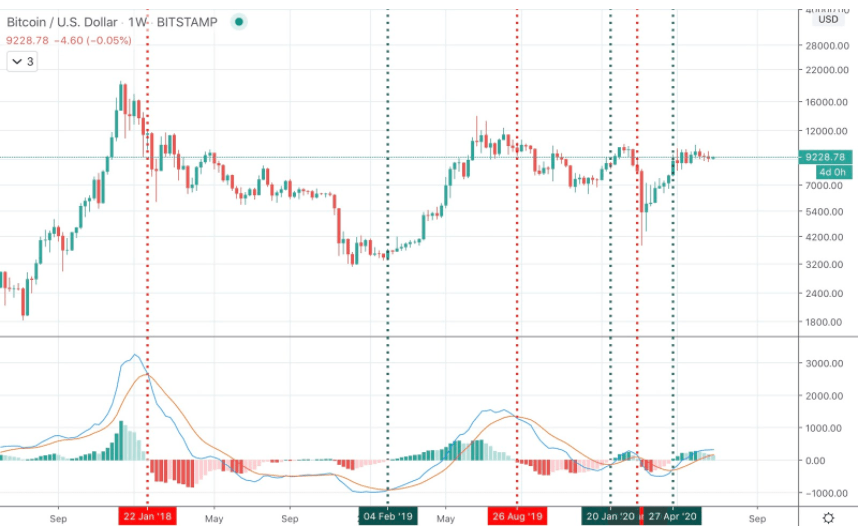

In the example below, bearish and bullish crossovers on the MACD are used to spot trend reversals.

The next example instead uses a touch of the Parabolic SAR indicator, hence its name “stop and reverse.”

Next, extreme readings on the RSI can signal a reversal.