Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Highlights

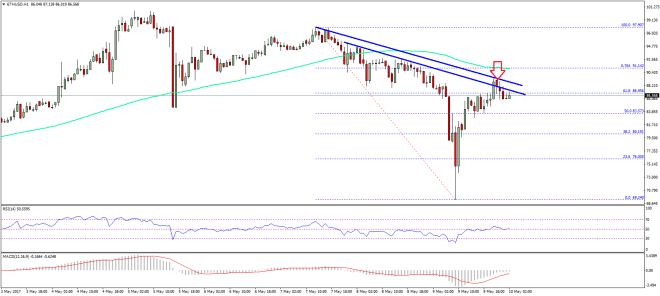

- There was a nasty decline in ETH price yesterday, as it dipped towards $70 against the US Dollar.

- There was a decent recovery from $70, and now two bearish trend lines at $88 on the hourly chart (ETH/USD, data feed via SimpleFX) are acting as a resistance.

- The price may dip once again towards $80 before gaining bids for an upside move.

Ethereum price dipped sharply intraday against the US Dollar and Bitcoin, and now the current recovery in ETH/USD is facing a major hurdle near $88.

Ethereum Price Major Resistance

Yesterday, we were looking for a slight increase in bearish pressure, as ETH price dipped below $85 against the US Dollar. Later, the price extended its downside move, and weakened by more than $10. A decline was initiated from $85 to $70, as the price traded as low as $69.20. Before that, there was a failure to break the 76.4% Fib retracement level of the last wave from the $85.10 low to $97.70 high. It resulted in a sharp decline, and the price even broke the $80 swing low.

Thankfully, the price found support near $70 and started a recovery. It has already moved above the 50% Fib retracement level of the last decline from the $97.90 high to $69.24 low. It is a positive sign, but the price is currently struggling near $88. There are two bearish trend lines at $88 on the hourly chart of ETH/USD, which are acting as a resistance.

We can also say that the price is struggling to close above $90. Above 90, the 100 hourly simple moving average at $91.20 is also waiting to act as a barrier. So, I guess there can be another dip before the price bounces above $90.

Hourly MACD – The MACD is about to move from the bearish to bullish zone.

Hourly RSI – The RSI is currently just around the 52 level.

Major Support Level – $80

Major Resistance Level – $90

Charts courtesy – SimpleFX