Let’s explore the best 100x leverage crypto platforms so that you can maximize your potential returns.

Using leverage is a high-risk, high-reward strategy. It enables you to borrow more funds than you currently hold to open new positions that, without leverage, would be out of reach.

Our crypto and tech experts did their due diligence and concluded that Binance, MEXC, and BloFin are among the best exchanges enabling you to trade crypto with 100x leverage. Let’s unwrap their trading experiences.

The Best 100x Leverage Crypto Trading Exchanges at a Glance

Before breaking down the specifics, here’s a quick summary of our top eight choices for crypto trading with 100x leverage.

- CoinFutures – Go Long or Short with 1000x Leverage & Instant Cash Out

- Binance — Utilize Leverage Backed by Liquidity & Straightforward Margin Tools

- MEXC — Trade 600+ Futures Contracts With Up to 400x Leverage to Maximize Gains

- BloFin — Boost Your Leverage Control With Advanced Limit, Reverse & TP/SL Orders

- Margex — The Best No-KYC Platform with a Powerful Copy Trading Tool for Crypto Novices

- PrimeXBT — One-Click Trading Feature to Quickly Open & Close Positions With Varying Leverage

- Bybit — ‘Smart Leverage’ Tool for High-Reward Returns Without Liquidation Risks

- KCEX — Set Leverage Risk Levels Across 2K+ $USDT-Pegged Crypto Pairs

The Best 100x Leverage Crypto Exchanges in 2025 Reviewed

Now, let’s dive into the best crypto exchanges in 2025, where you can trade crypto with 100x leverage (and even more!), so that you can immensely boost your earning potential.

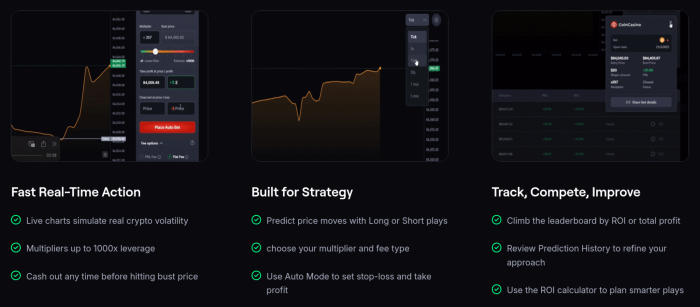

1. CoinFutures – Go Long or Short with 1000x Leverage & Instant Cash Out

- Max leverage: 1000x

- Fees: Either a 5% PnL fee or a 1%–3% flat fee when opening and closing a bet.

- Supported cryptos: $BTC, $ETH, $DOGE, $TRX, $LTC (with more coming soon).

CoinFutures is unmatched if you just want to bet on crypto price movements but find trading too stressful or needlessly complex. This betting platform strips away all the noise and technicalities, letting you go long or short with up to 1000x leverage straight after signup.

You won’t have to worry about order book depth, macro events affecting the market, or short squeezes and liquidation. On CoinFutures, the price bets are entirely simulated, powered by a smart algorithm that mimics the real market experience (but without real market exposure).

All you have to do is select your crypto and multiplier, choose to go long or short, and place a bet. The charts move fast, and you can watch your profits or losses in real-time.

You don’t even have to wait for your price prediction to come true. You can cash out at any time if you want to lock in early profits.

To better simulate the traditional exchange trading experience, CoinFutures also lets you set stop loss and take profit orders. This way, you can time the best exit and manage risk, especially if you choose to go high on the leverage.

Fees also follow a different structure. CoinFutures doesn’t charge anything for deposits. As for the bets, you get to choose between two options.

The first is a PnL fee — 5% for every profitable bet and an additional 0.5% fee for every hour your bet stays open. In this case, you don’t pay for opening a position.

The second option is a flat fee, ranging between 1%–3% of your wager. The amount you pay depends on the size of your bet, including the multiplier. This fee applies both when you open and close a position.

2. Binance – Utilize Leverage Backed by Liquidity & Straightforward Margin Tools

- Max leverage: 125x

- Futures trading fees: Depends on 30-day trade volume

- Supported trading pairs: 1.5K+

As the world’s largest crypto exchange with over 250M registered users, Binance is a fantastic option for futures trading up to 125x leverage. This means that, on specific trading pairs (it supports a hefty 1.5K), you can control a sizable $12.5K investment with just $100.

As part of its ploy to incentivize active traders, it offers a competitive fee structure that depends on your 30-day volume. However, you can get discounts by using its native coin, $BNB (25%), and through its VIP programs.

Also, when it comes to fees, be sure to keep an eye on the margin loan interest fees, which fluctuate every hour. These fees can eat into your potential gains, so staying informed is essential. You’ll find them clearly displayed at the top right of the margin trading interface.

When margin training, you can choose between two different position modes – cross margin and isolated margin – to minimize risks in case of loss or liquidation.

Its futures contracts are marked-to-market every day, which means your profits or losses will be reflected in your account balance daily.

While you might find Binance’s fee structure a little burdensome, this top crypto exchange ensures complete transparency at every step, as evidenced by its real-time updates on margin interest and clearly displayed fee structures.

3. MEXC – Trade 600+ Futures Contracts With Up to 400x Leverage to Maximize Gains

- Max leverage: 400x

- Futures trading fees: 0% maker and 0.02% taker

- Supported trading pairs: 1K+

MEXC stands out for supporting 1,125 futures pairs across 600 futures contracts. It’s a top choice if you want extensive futures trading options with the highest leverage of 400x compared to our other top choices.

When trading perpetual futures on the CEX, you can select a leverage multiplier that applies to your futures trading pair, using either cross or isolated margins.

Suppose you leverage $BTC/$USDT with up to 400x leverage, you could control a $10K position worth the equivalent of $4M $BTC. However, if it moves against you, losses could exceed your initial investment. So, while it’s the most profitable option, it’s the riskiest.

Regardless of which asset pair, margin type, or leverage you select, futures trading fees stay the same: 0% for makers and 0.2% for takers, which ensures transparent, low-cost transactions for all involved.

Moreover, MEXC offers technical indicators (Moving Averages, Bollinger Bands, and Stochastic Oscillators) that help you make wiser investment decisions. This way, you can formulate a trading strategy based on your investment goals and current market conditions.

It also has a wide range of security features that help keep your digital riches safe, such as 2FA, a withdrawal whitelist, cold storage, anti-phishing codes, and regular security audits.

4. BloFin – Boost Your Leverage Control With Advanced Limit, Reverse & TP/SL Orders

- Max leverage: 150x

- Futures trading fees: 0.02% maker and 0.06% taker

- Supported trading pairs: 576

BloFin is another leverage trading crypto platform worth eyeing. It currently offers 576 trading pairs with leverage up to a sizable 150x. Therefore, you can maximize your earnings without an expiration or delivery date.

Its trading pairs are coupled with $USDT, one of the most popular stablecoins. Because it’s pegged to the US dollar, it provides stability in the often volatile crypto realm.

Leverage is only applicable when trading futures contracts on BloFin using either cross or isolated margin modes, currently across eight order types:

- Market order: Enter or exit leveraged positions straight away.

- Limit order: Open or close leveraged positions at a certain price.

- Trigger order: Executes when a trigger price is hit, so you can better manage leveraged trades.

- TP/SL order: Take profit or stop loss triggers to manage leverage risks.

- Trailing stop order: Follow market trends automatically to minimize risks.

- Reverse order: Closes an existing leverage position and opens an opposite one automatically.

- Advanced limit order: Refines how leveraged orders are executed on the order book.

- WRAP order: Breaks large leveraged orders into small timed segments to reduce slippage.

It has a Maintenance Margin Rate (MMR) that increases with each tier. The MMR is the minimum collateral you must maintain to keep your position open. If it’s not met, your position might face liquidation.

Like most exchanges, it has cross margin and isolated margin options, so you can choose between maximizing your capital efficiency across positions or limiting your risks to individual trades.

You can also decide whether to buy (long) or sell (short). This will depend on your strategy and outlook, and give you the flexibility to profit when the market’s in its prime – and vice versa.

To prevent prices from being manipulated, it sets boundaries on how high and low prices can go, depending on the token, contract type, and volatility. If you exceed such limits, your order will be canceled.

Its strategic collaborations also help it remain secure. Joining forces with Fireblocks provides cold wallet security and insurance coverage (1:1), which backs up your funds in the event of cyber or operational threats.

While it’s a great option for flexible, $USDT-settled contracts and risk management, it might not be your top pick if you seek the lowest fees. It has the highest futures taker fee at 0.06% among our options.

JOIN BLOFIN fOR aDVANCED oRDERS

5. Margex – The Best No-KYC Platform with a Powerful Copy Trading Tool for Novices

- Max leverage: 100x

- Futures trading fees: 0.060% taker, 0.019% maker

- Supported trading pairs: 60

Margex lives up to its name, offering an intuitive and reliable platform explicitly designed for margin traders. Whether you’re looking to leverage your positions or explore advanced trading strategies, Margex is your go-to destination for margin trading.

While not suitable for spot trading, it’s the perfect solution for futures trading with up to 100x leverage, especially if you care about hiding your digital footprint—it’s proudly our number one no-KYC platform.

The CEX currently offers 60 crypto pairs traded against the US dollar to provide a stable, consistent benchmark.

It only offers 100x leverage on specific assets, including $BTC/USD and $ETH/$USD, likely because they have the highest liquidity on the platform. Nevertheless, if you’re open to trading new and upcoming cryptos at lower leverage levels, there are plenty of other options to explore.

Regardless of which crypto pair and leverage ratio you choose, the fees are fixed and transparent: 0.060% for takers and 0.019% for makers. You can rest easy knowing exactly what you’re paying – no hidden costs or surprises, just competitive rates each time you trade.

If you are unsure which market to move to, Margex’s copy trading tool can help. It allows you to mirror the trading strategies of top-performing traders in real-time, so you can profit from their movements without deep insider knowledge being a necessity.

The exchange’s security protocols are also worth a shout-out. To secure your funds, it employs real-time monitoring alerts, cold storage, multi-sig, and Distributed Denial of Service (DDoS) protection.

6. PrimeXBT – One-Click Trading Feature to Quickly Open & Close Positions With Varying Leverage

- Max leverage: 200x

- Futures trading fees: 0.01% maker and 0.045%

- Supported trading pairs: 36

On PrimeXBT, you can trade various derivatives with leverage up to 200x – not only in crypto but also in forex, commodities, and other financial instruments.

PrimeXBT’s leverage depends on current market dynamics and volatility of the 36 crypto pairs it supports. Highly liquid assets, for instance, often provide amplified leverage opportunities than vice versa.

When trading with leverage on the CEX, you can review trading conditions for any selected asset. This includes its high/low price over 24/hours, financing rates, volume, and maker and taker fees (0.045% taker and 0.01% maker for all trading pairs).

For added control, you can easily access more detailed specifications by clicking the book-like symbol at the top right. This gives you insights into the minimum order size, maximum single order size, maximum exposure, and available leverage.

Regarding derivatives, options allow you to control 100 shares with a lower upfront cost. Futures let you trade popular contracts, though they come with price limits. Meanwhile, CFDs (Contracts for Difference) offer leverage and the flexibility to trade around the clock.

And there’s more. It has a one-click trading feature that quickly opens and closes positions and cancels orders. If you want to boost speed, convenience, and precision, it can be added to your trading settings as a default – a helpful tool when the market’s moving at lightning speed.

TRY ONE-CLICK TRADING ON PRIMEXBT

7. Bybit – ‘Smart Leverage’ Tool for High-Reward Returns Without Liquidation Risks

- Max leverage: 200x

- Trading fees: 0.055% taker and 0.02% maker

- Supported trading pairs: 11 (on Smart Leverage)

Bybit is an excellent choice for trading both long and short contracts with up to 200x leverage, offering zero risk before settlement. Its Smart Leverage tool ensures no trading fees, along with flexible redemption options.

It protects all investments from liquidation risks between the subscription and settlement periods, which allows your position to withstand market fluctuations.

Additionally, it gives you the flexibility to redeem your earnings at any time, before the settlement period ends, to help you avoid having your position stopped early by temporary volatility.

Here’s how it works: In standard derivatives trading, say you invest 5K $USDT into a long position on $BTC/$USDT with 200x leverage at an entry price of 51K $USDT; even a 0.5% price drop would trigger liquidation.

However, there are no liquidation risks. Smart Leverage remains unaffected by price fluctuations before the settlement date. If the breakeven price is 52K $USDT and the settlement price ends up being 53K $USDT, you’ll secure a gain, amplified by the high leverage exposure.

One slight downfall is that only 12 cryptos can be paired with $USDT when using the Smart Leverage tool, including:

- 💰 $BTC

- 💰 $ETH$BNB

- 💰 $DOGE

- 💰 $DOGS

- 💰 $NOT

- 💰 $SOL

- 💰 $SUI

- 💰 $TON

- 💰 $TRUMP

- 💰 $XAUT

- 💰 $XRP

Still, they are some of the most traded on the market and offer ample high-leverage strategies.

If you are new to crypto, the exchange also offers many trading tools to give you a leg up, including copy trading, a trading bot, and demo trading.

Nevertheless, you might be cautious about trading on Bybit after it faced a $1.5B hack by the North Korean Lazarus Group on February 21, 2025. If that’s the case, you’ll be happy to know that it promises to reimburse all involved.

Furthermore, it has enhanced its security features, including its multi-signature authorization process and collaboration with blockchain analysis and security firms Chainalysis, Arkham Intelligence, and Elliptic.

Also, to provide transparency, it regularly conducts proof of reserve audits and publishes them publicly to provide transparency. Still, the ball is in your court.

8. KCEX – Set Leverage Risk Levels Across 2K+ $USDT-Pegged Crypto Pairs

- Max leverage: 100x

- Futures trading fees: 0% maker and 0.04% taker

- Crypto support: 2K+

Last but not least, KCEX is another helpful platform for crypto trading with 100x leverage on select pairs. It supports over 2K $USDT-based trading pairs with isolated and cross-margin options.

The exchange’s interface has an intuitive slider to adjust the leverage and position size to quickly set risk levels without typing in the specifics. Instead of having fixed leverage, it gives you flexibility based on asset volatility and market liquidity.

Moreover, the leverage you pick is clearly visible on the right-hand side of the home page, which reduces user error and keeps you aware of your position.

Moreover, it has a built-in take profit/stop loss configuration before order execution, helping you manage your positions more safely.

When engaging in perpetual futures trading on the KCEX, you can use technical indicators like the Moving Average, Relative Strength Index, and Bollinger Bands to identify trends and spot prosperous entry and exit points. Ultimately, this helps you to manage risks better.

Its cutting-edge security protocols also boost your efforts to manage risks. It stores 100% of funds in cold wallets (away from online threats) and utilizes 2FA and multi-signature wallets to prevent unauthorized account access.

How We Selected the Best 100x Leverage Crypto Platforms to Invest in

Rest assured, our review is backed by hands-on testing of each exchange to ensure it’s safe, reliable, and user-friendly. In this section, we’ll walk you through the key factors we used to select the best 100x leverage crypto platforms to invest in.

- Security protocols: We check that the exchanges have strong security features in place, like 2FA, cold wallet storage, and insurance funds, so that they protect your assets in the event of a breach.

- Community sentiment and reputation: We gauge exchanges’ community sentiment on their social platforms and review websites like TrustPilot to ensure our review isn’t biased. We also check its history of hacks and breaches.

- Fees and funding rates: We ensure the exchanges we highlight have competitive rates and are transparent, so you’re not unfairly hit with unwanted costs.

Supported assets: We select exchanges that offer a good range of assets so that you can diversify your crypto portfolio without going elsewhere. - User-friendly interface: We evaluate platforms for their ease of use and functionality to ensure they’re suitable for both novice and seasoned crypto users alike.

- Risk management tools: We recommend exchanges that support stop-loss, take-profit, and other tools that help manage risks at high leverage.

- Liquidity and volume: We select platforms with high trading volumes and deep order books to ensure minimal slippage and quick execution, particularly during market volatility.

- Bonus features: We give extra points to those that offer features like technical indication, demo accounts, and copy trading to enhance your trading experience beyond pure speculation.

What Is 100x Leverage in Crypto?

100x leverage trading (otherwise known as margin trading) allows you to borrow capital from a broker (in this case, the best crypto exchanges) to increase the size of your positions.

It allows you to trade with more crypto than you own by borrowing funds with leverage, which, depending on the amount, is expressed as multiples, such as 10x, 25x, or, in this case, 100x.

It’s facilitated by the positions’ long (buy) and short (sell), allowing you to profit from favorable and unfavorable market conditions.

How Does 100x Leverage Trading Work?

Leverage indicates how much power you can gain to control a more prominent position, such as 1:10 (10x), 1:50 (50x), or 1:100 (100x).

With 100x leverage, you need only place down 1% of personal funds (margin) to open a leveraged position. So, suppose you place down a $100 BTC investment; your investment would be worth $10K.

But beware: If the market moves against you by just 1%, your position can be liquidated, and you will lose your entire margin.

When leverage trading, you must be careful of liquidation. This occurs if a reserved margin becomes insufficient and can’t cover a trade’s losses. Then, positions are usually automatically closed.

An estimated liquidation price is automatically provided for an isolated margin. Meanwhile, liquidation typically occurs for cross-margin positions when the level drops below 10% (as is the case on Margex).

Pros and Cons of 100x Leverage Trading in Crypto

There are both benefits and downsides to 100x leverage crypto trading, as follows:

✅ Pros:

- ✅ Significant profit potential: You can maximize profits from small price moves.

- ✅ Capital efficiency: You only need a small margin to open large positions.

- ✅ Access to big markets: Small investors can trade expensive assets like $BTC and $ETH at large.

❌ Cons:

- ❌ Liquidation risks: A 1% move against your position can wipe you out.

- ❌ Emotional stress: Quick-moving trades can lead to impulsive decisions and burnout.

- ❌ Slippage and volatility: Sudden market changes can lead to large losses quickly, even beyond the initial margin.

How to Stay Safe While Leverage Trading Crypto

Considering 100x leverage on crypto is a risky endeavour, there are specific tactics that can help minimize risks.

|

Leverage Trading Tactics

|

Details |

|---|---|

|

Trade on a reputable platform

|

To minimize the risk of technical issues and unfair liquidations, trade on exchanges with strong security and stable execution (like Binance, MEXC, or CoinFutures).

|

|

Use stop-loss orders

|

To protect against sudden market moves, you can set automatic exits to limit possible losses.

|

|

Maintain sufficient collateral

|

You can keep more collateral than the minimum required to reduce liquidation risks for small price swings.

|

|

Don’t go ‘all in’

|

You don’t have to commit your entire balance to one trade to prevent emotional decision-making and preserve capital for future opportunities.

|

|

Use a small percentage of capital

|

To help you survive losses without blowing your account, you can use small leverage before potentially moving up to 100x.

|

|

Leverage technical analysis tools (indicators)

|

To improve your investment decisions based on market sentiment and trends, you can use indicators like RSI and MACD to better time entries and exits.

|

Are the Best 100x Leverage Crypto Platforms Worth It?

Trading crypto with 100x leverage can be mighty rewarding, albeit not without risks. Unless you take advantage of Bybit’s Smart Leverage tool that prevents you from being liquidated, it’s not for the faint-hearted.

As you now know, crypto exchanges like Binance, MEXC, and BloFin each offer powerful tools with flexible margin modes, enabling you to trade hundreds (if not thousands!) of trading pairs so you can benefit from market movements at a large scale.

Whether you’re most attracted to the ability to leverage technical analysis, zero maker fees, or complete anonymity, each of our options has distinct benefits depending on where your interest lies.

⚠️ Disclaimer: This article is solely for information purposes only and is not financial investment advice. Leveraged trading (especially 100x!) carries tremendous risk. Always do your homework before getting started.

FAQs

1. What is 100x leverage in crypto?

100x leverage in crypto means you can control a position a hundred times larger than the capital you put down. Suppose you only put down $100; it enables you to open a trade worth $10K.

2. How does 100x leverage work?

100x leverage allows you to borrow funds at a much more prominent position than your actual capital. All you need to do is deposit, activate 100x leverage, and open a position (for example, 100 x $1000).

In most cases, say the price moves just 1% in your favor, you’ll be up $100 (a 100% return!). However, if it moves 1% against you, you’ll be liquidated and lose $100.

3. What’s the best 100x leverage crypto exchange?

We like CoinFutures for its gamified approach to leverage trading, which removes much of the complexity of trading. Binance is another reliable choice owing to its smart tools, such as trading pair filters, daily profit/loss updates, and transparent margin interest displays. Add in competitive fees and $BNB discounts, and we believe it offers unmatched flexibility and transparency.

However, your favorite crypto leverage trading platform will depend on your personal goals. If you want the highest leverage (up to 400x), your go-to platform will likely be MEXC.

4. Which crypto exchange has 100x leverage?

Most crypto exchanges offer 100x leverage on specific cryptocurrency pairs, typically the most popular ones (like $BTC, $ETH, $SOL, $XRP) against stablecoins, because they’re more liquid and secure.